Font size:

Print

Virtual Digital Assets (VDAs) & the OECD’s Crypto-Asset Reporting Framework (CARF)

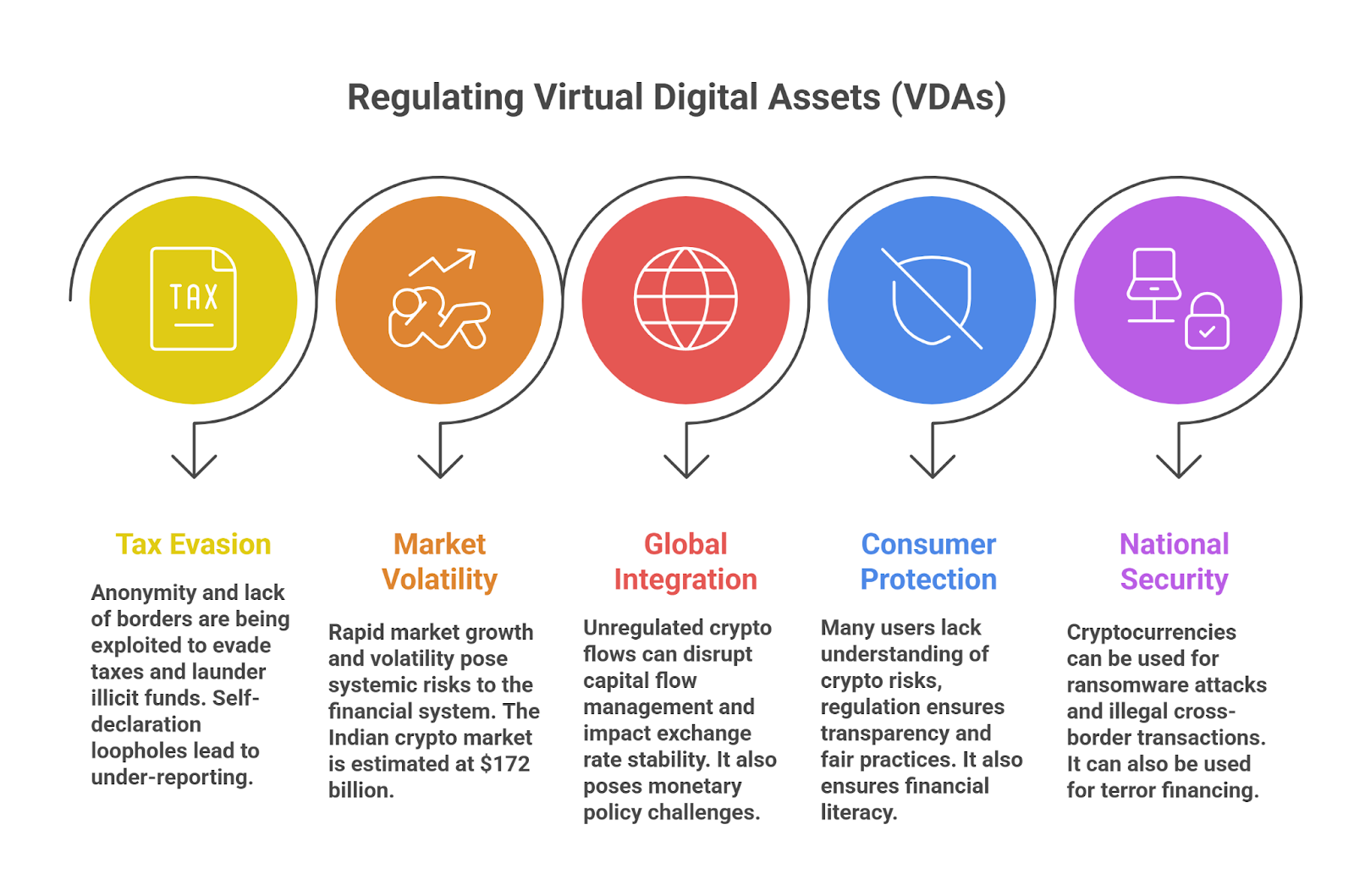

Context: Virtual Digital Assets (VDAs) are reshaping global finance, raising concerns of tax evasion and transparency. From April 1, 2027, India will adopt the OECD’s Crypto-Asset Reporting Framework (CARF) to enhance compliance and align with global regulatory standards.

What are Virtual Digital Assets (VDAs)?

- As per Section 2(47A), Income Tax Act, 1961 – VDAs include cryptocurrencies (e.g., Bitcoin, Ethereum), non-fungible tokens (NFTs), and other cryptographically generated digital tokens. They represent digital value transferable/storable electronically, functioning as a unit of account, store of value, or medium of exchange.

- Exclusions: Gift cards, loyalty points, stocks, bonds, or traditional financial assets.

- Taxation in India: Income from the transfer of VDAs is taxed at 30% (flat rate) plus 1% TDS on transactions. Reporting is mandatory in Income Tax Returns (Schedule VDA + Schedule FA for foreign holdings).

How can the Crypto-Asset Regulating Framework help in keeping a check on the VDAs?

The OECD’s CARF (to be implemented in India from April 1, 2027) aims to:

- Automatic Exchange of Information (AEOI): Foreign exchanges & wallet providers must report details of Indian residents’ holdings. Shared with Indian tax authorities under the Multilateral Competent Authority Agreement (MCAA).

- Comprehensive Reporting: Covers crypto-to-fiat trades, crypto-to-crypto swaps, wallet transfers (including unhosted wallets), stablecoins, crypto derivatives, and NFTs. Includes high-value retail payments above $50,000.

- Verification vs Self-declaration: Currently, foreign crypto holdings rely on self-disclosure in tax returns. CARF enables verified third-party reporting → cross-checking taxpayers’ declarations.

- Curbing Tax Evasion: Indian authorities can issue notices for undisclosed offshore crypto holdings. A deterrent against black money and money laundering.

- Global Coordination: Over 50 jurisdictions adopting CARF by 2027. Creates a level playing field across countries and avoids loopholes.

- Building Trust & Stability: Provides transparency & accountability in crypto markets. Encourages responsible innovation while curbing misuse.