Font size:

Print

Urban Challenge Fund: Driving Resilient and Sustainable Indian Cities

Urban Challenge Fund: A Bold Path to Stronger Indian Cities

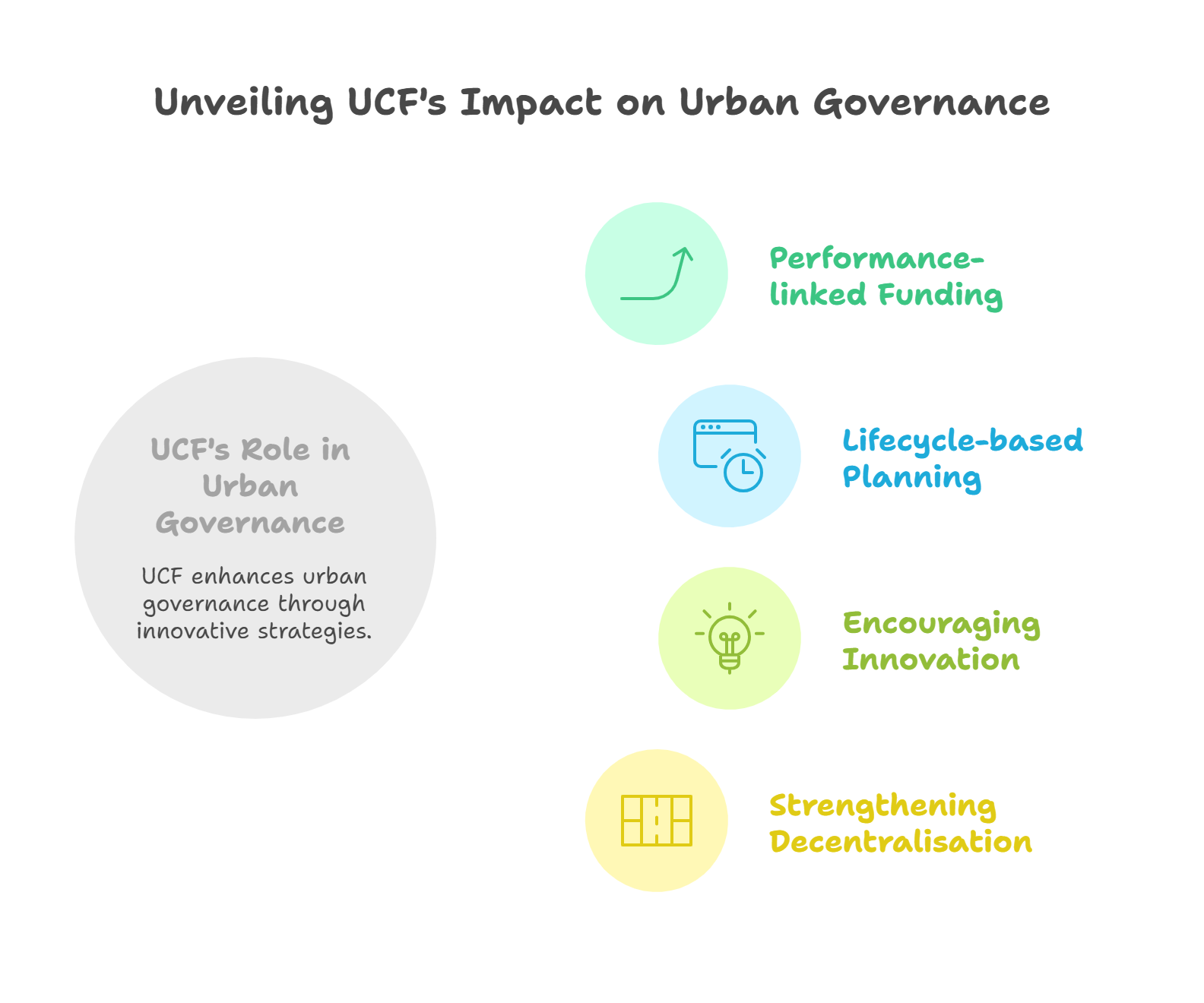

Context: The Urban Challenge Fund reflects India’s urgent push to address rapid urbanisation, outdated infrastructure, and funding gaps in city governance. At a time when cities contribute over 60% to GDP yet face rising climate risks, housing shortages, and service deficits, this performance-linked initiative aims to make urban centres resilient, sustainable, and engines of growth.

What is an Urban Challenge Fund (UCF)? Why is there a need for it?

- The Urban Challenge Fund (UCF), announced in the Union Budget 2025–26, is a performance-linked funding mechanism with an allocation of ₹1 lakh crore. It aims to support projects in cities as growth hubs, creative redevelopment, and water & sanitation.

- The need for UCF arises from India’s underinvestment in urban infrastructure. According to the Economic Survey 2023–24, India spent just 0.6% of GDP on urban infrastructure (2011–2018)—far below the required 2–3%.

- Meanwhile, urbanisation is accelerating, with the Census 2021 expected to classify over 60% of India’s population as urban by 2036 (NITI Aayog, Transforming India’s Urban Landscape).

Existing schemes like the Smart Cities Mission mobilized innovation but struggled with private sector participation (only 6% projects under PPPs), showing the urgency for a new funding model.

What are the major issues associated with it?

- Weak financial capacity of ULBs: Out of 470 municipal corporations, only 36 hold investment-grade credit ratings (Economic Survey 2021–22). This undermines their ability to raise bonds or loans.

- Past failures of PPPs: Experience from the Smart Cities Mission and Viability Gap Funding scheme shows low investor interest due to bureaucratic hurdles and delayed clearances.

- Risk of exclusion of Tier-2/3 cities: Bankability focus may sideline smaller cities where urbanization is growing fastest.

- Underutilisation of funds: Programmes like Swachh Bharat Mission (2024–25) saw drastic budget revisions (₹5,000 cr to ₹2,159 cr), raising concerns about absorptive capacity.

What measures can be taken to address it?

- Enhance municipal revenues: Improve property tax collection (currently just 0.35% of GDP vs global average of 1%) and rationalise user charges.

- Credit enhancement mechanisms: Tools like first-loss guarantees and the proposed NaBFID partial credit guarantee fund can reduce risk for private investors.

- Capacity building of ULBs: Establish dedicated project preparation cells with technical and financial expertise.

- Focus on innovation & outcomes: Adopt performance-linked frameworks, as seen in Swachh Survekshan rankings, to drive accountability.