To Build Ships, India Must Look East: Unlocking Strategic Partnerships for Maritime Power

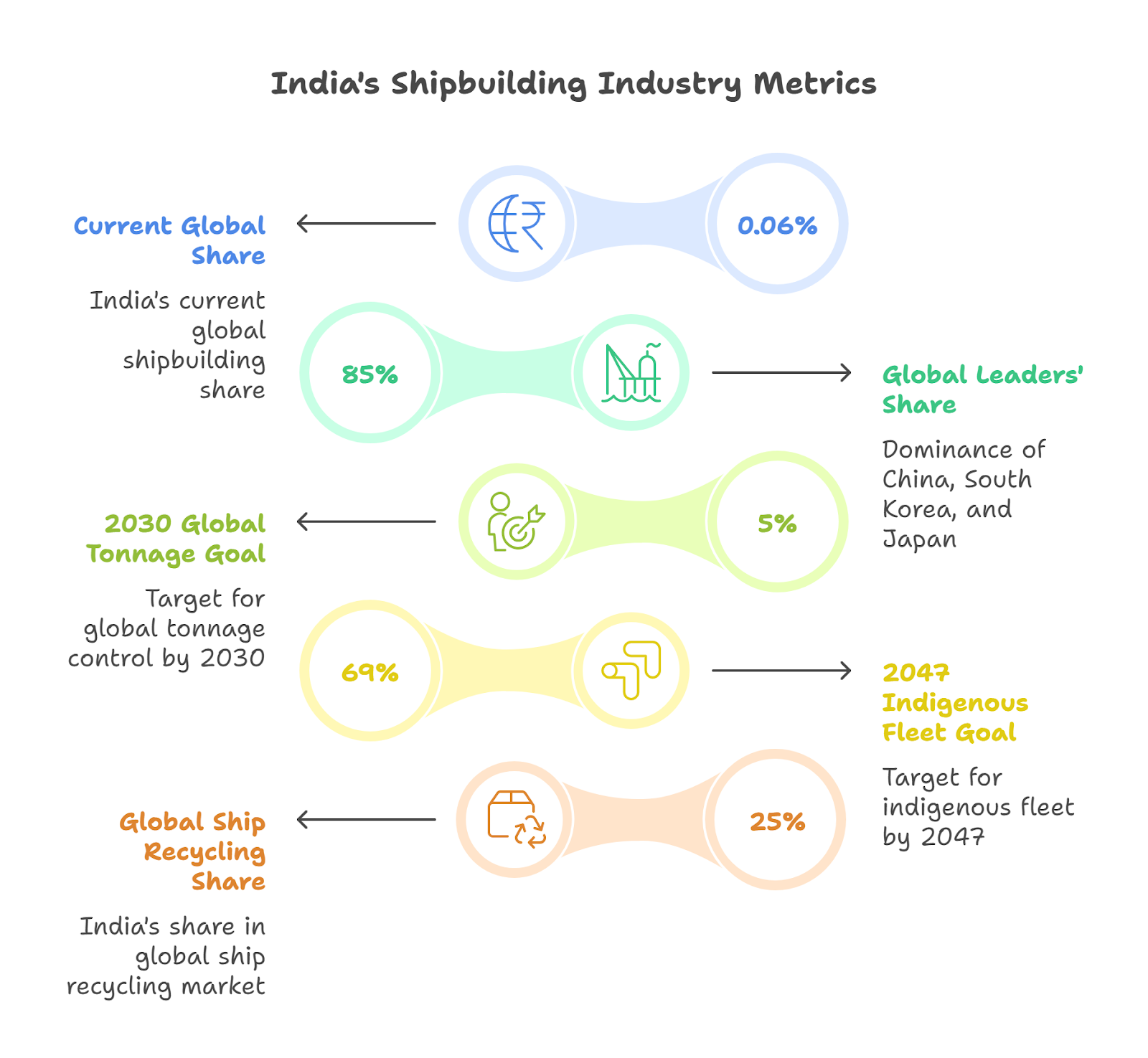

Context: Amid shifting global supply chains and rising maritime competition, India is prioritising shipbuilding to strengthen economic and security resilience. Strategic partnerships with Japan and South Korea, alongside domestic capacity building, are key to advancing its shipbuilding ambitions.

What measures have been taken to augment India’s shipbuilding industry?

The Government has pursued a mix of fiscal, policy, and institutional measures:

- Financial Support: A ₹30,000 crore Maritime Development Fund and Shipbuilding Financial Assistance Policy (SBFAP) 2.0 aim to attract private and foreign capital (Economic Survey 2024-25).

- Cluster Development: Plans for 8 shipbuilding clusters across Maharashtra, Andhra Pradesh, Tamil Nadu, Gujarat, Odisha, and Kerala, with ₹75,000 crore allocated. These include both greenfield and expanded facilities at major ports like Vadinar, Kochi, and Kandla.

- Vision Frameworks: Maritime India Vision 2030 and Amrit Kaal Maritime Vision 2047 provide clear roadmaps for scaling up domestic shipbuilding and repairs.

- State Incentives: Maharashtra’s Shipbuilding, Repair, and Recycling Policy 2025 offers 15% capital subsidy and R&D grants; Andhra Pradesh has set up a logistics corporation and maritime policy to attract investors.

How can East Asian countries help in augmenting India’s shipbuilding industry?

Japan and South Korea—global leaders in shipbuilding—can provide India with the missing technology, capital, and industrial standards.

- South Korea: In 2024, HD Korea Shipbuilding & Offshore Engineering (KSOE) signed an MoU with Cochin Shipyard to cooperate in workforce upskilling, technical expertise, and productivity. Hanwha Ocean also set up a Global Engineering Centre in Noida, focusing on advanced offshore designs such as FPSOs and FLNGs.

- Japan: Engagements with Mitsubishi Heavy Industries, Imabari Shipbuilding, and Japan Marine United Corporation (JMUC) are exploring joint ventures. Mitsui O.S.K Lines (MOL) has also shown interest in investing in Indian logistics, signaling long-term collaboration.

These partnerships can help India overcome persistent challenges in delivery schedules, safety standards, and quality control, aligning with global benchmarks. They also carry a geopolitical edge, as India, Japan, and South Korea share converging interests in countering China’s dominance in the sector (Down To Earth, 2025).

What challenges does India face in becoming a shipbuilding hub?

Despite policy push, India faces stiff competition:

- Ship Recycling: Bangladesh and Pakistan challenge India’s Alang yard dominance.

- Ship Repair: Singapore, Dubai, and Bahrain lead globally due to advanced technology and skilled workforce.

- Infrastructure Needs: Large waterfront land parcels and deep channels remain scarce, limiting the ability to handle large vessels.

- Investment Gaps: Attracting global majors like Hanwha, Samsung, and Mitsui requires sustained fiscal incentives and faster clearances.