Font size:

Print

Rise of Contractual Labour in India

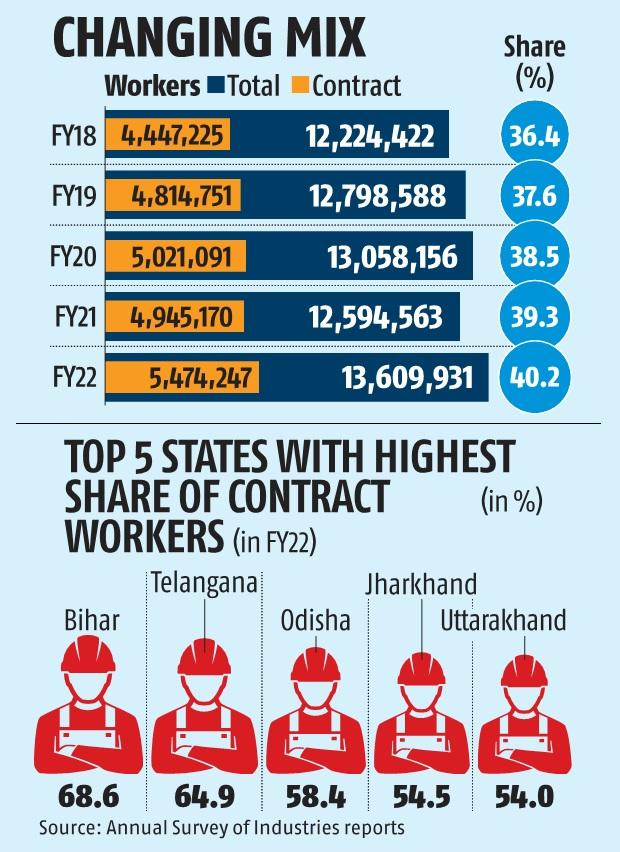

Context: In recent decades, India’s formal manufacturing sector has seen a sharp rise in contractual employment, with contract workers now making up 40.7% of the workforce (up from 20% in 1999-2000) as per Annual Survey of Industries (ASI) data.

Why Are Contractual Workers Preferred in Formal Industries in India?

- Cost-Cutting: Contract workers are cheaper—employers save 24% on labour costs compared to regular workers. In some industries, the gap is as high as 85%.

-

- Economic Survey 2022-23 notes that contractualisation is most prevalent in labour-intensive sectors (textiles, automobiles).

- Regulatory Avoidance: Firms bypass labour laws (like the Industrial Disputes Act, 1947) that protect permanent workers from arbitrary dismissal.

- Flexibility: Businesses can adjust workforce size based on demand without long-term commitments.

- Third-Party Hiring: Labour contractors handle recruitment, reducing administrative burden for companies.

What Are the Challenges Associated with Contractual Workers?

- Lower Wages & Exploitation: Contract workers earn 14.5% less than regular employees, with disparities worse in large firms (31% gap).

- Lower Productivity: Firms relying heavily on contract workers show 31% lower productivity.

- World Bank Report (2023) warns that excessive informalisation in formal sectors may hinder India’s manufacturing competitiveness.

- High Turnover: Short-term contracts discourage skill development.

- Principal-Agent Problem: Third-party contractors may not align with long-term business goals.

- Social Security Gap: Only 18% have EPF/ESI coverage (Labour Ministry, 2023).

- Labour Bureau Report (2021) finds that wage disparity between contract and regular workers has widened post-2015.

- Skill Deprivation: Limited training opportunities hinder innovation and efficiency.

What Actions Have Been Taken to Address These Challenges?

-

- Labour Codes (2020): Allow fixed-term contracts (without third-party mediators). Mandate statutory benefits (like gratuity) for temporary workers.

- Pradhan Mantri Rojgar Protsahan Yojana (PMRPY): Government paid 12% employer’s EPF contribution (2016-2022). Benefitted 1 crore workers, but discontinued in 2022.

-

Proposed Reforms:

-

- Subsidised skilling programs for contract workers.

- Tax incentives for firms offering longer-term contracts.