Font size:

Print

Remittances in India’s External Sector: A Powerful Stabilising Force in Uncertain Times

Remittances in India’s External Sector: Key Driver of Economic Resilience and Growth

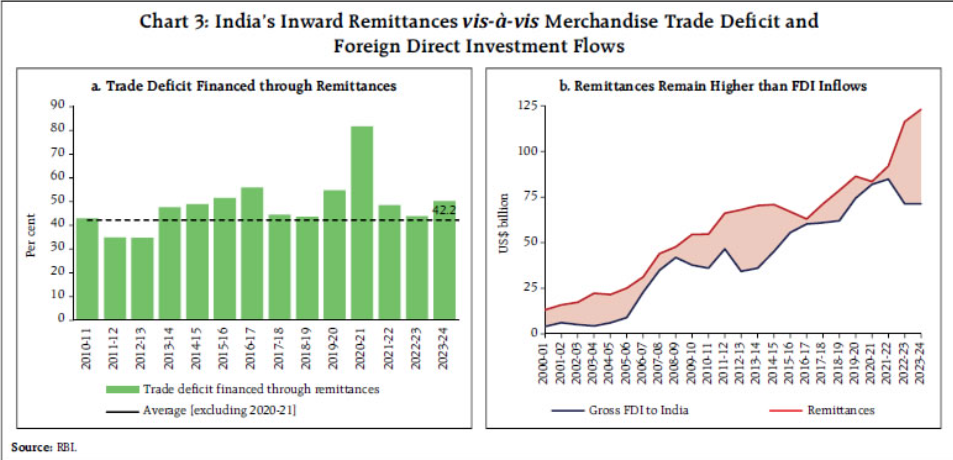

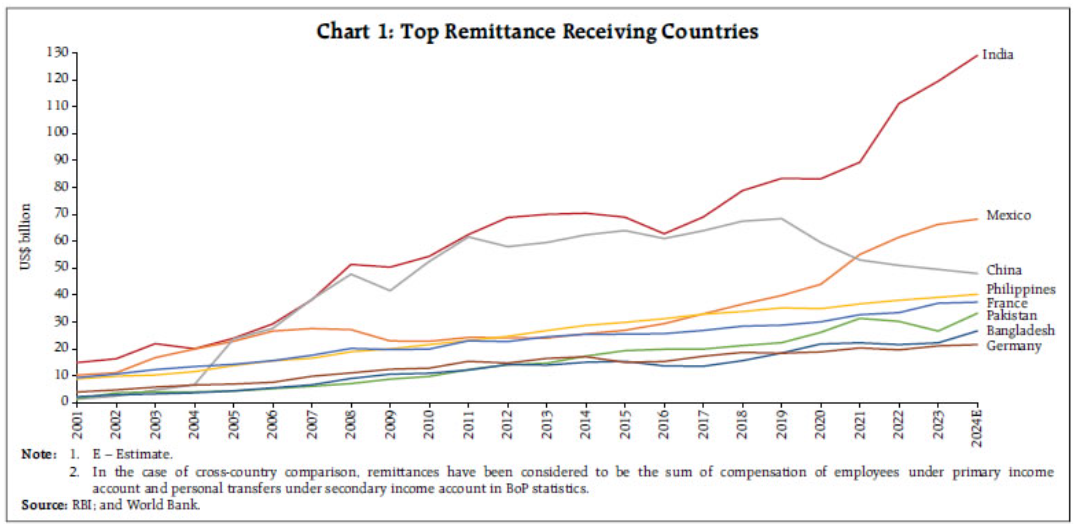

Context: Inward remittances reached a record $118.7 billion in 2023-24, surpassing FDI inflows and financing over 50% of the merchandise trade deficit. Remittances remain resilient despite tightening global financial conditions. However , despite their importance, remittances receive less policy attention compared to trade and FDI.

Structural Shifts in Remittance

- Rise of Advanced Economies (AEs)

-

-

- AEs now dominant: Combined share of the US, UK, Canada, Australia, and Singapore is 51.2%, overtaking the GCC’s 37.9%.

- The US leads with 27.7%, surpassing Saudi Arabia (6.7%) and Kuwait (3.9%) combined.

-

- Reasons for shift:

-

-

- Growth of high-skilled migration to AEs.

- Greater student migration to countries like the US (25.3%) and Canada (32%).

-

Corridor-Specific Digital Disparities

- High digital uptake in Gulf:

- Saudi Arabia: 92.7%

- UAE: 76.1%

-

- Lower digital penetration in AEs:

- Canada: 40%

- Germany: 55.1%

- Italy: 35%

- Declining Role of the Gulf Region: GCC’s share fell from 46.7% (2016-17) to 37.9% (2023-24).

-

-

- UAE’s share declined from 26.9% to 19.2%.

-

- Contributing factors:

-

-

-

- Oil price volatility and economic downturns.

- Job nationalisation policies (e.g., Saudisation, Emiratisation).

- Decreasing demand for low-skilled foreign labour.

-

-

- Changing Profile of Migrants

-

-

- Shift from low-skilled to high-skilled migration:

- 78% of Indian migrants in the US work in IT, finance, healthcare.

- STEM professionals earn 3–5 times Gulf salaries.

- One Silicon Valley engineer remits ≈10x that of a Gulf construction worker.

- Greater financial resilience of high-skilled workers during crises (e.g., COVID-19).

- Shift from low-skilled to high-skilled migration:

-

- Student Mobility as a Remittance Driver

-

-

- 13.4 lakh Indian students abroad, with major destinations:

-

- Canada: 32%

- US: 25.3%

-

-

- Remittances come through:

- Education loans taken in India.

- Post-study employment earnings abroad.

- Supported by immigration policies:

- UK’s Graduate Visa.

- Canada’s Post-Graduation Work Permit (PGWP).

- India-UK Migration and Mobility Partnership (2021) tripled Indian migration to the UK.

- Remittances come through:

-

- Transaction Patterns and Emerging Vulnerabilities

-

-

- High-value transaction dominance: Transactions above ₹5 lakh account for 29% of total value but only 1.4% of total transactions.

- Driven by professionally mobile, high-income migrants.

- Risk factor: A slowdown in high-skilled migration due to restrictive immigration policies could reduce these flows disproportionately.

-

- Increasing Digitalisation of Remittances

-

- Digital transactions now 73.5% of all remittance transfers (2023-24).

- Average remittance cost for sending $200 is 4.9%:

- Lower than global average (6.65%).

- Still above SDG target of 3%.

- Rise of fintech platforms and app-based services contributing to this shift.

Key Challenges

- Infrastructure and regulatory gaps constrain universal digital adoption: Need to strengthen cross-border digital payment linkages for lower costs and higher transparency.

- Sub-National Asymmetries in Remittance Inflows

-

-

- Kerala, Tamil Nadu, Maharashtra together account for 51% of total remittances.

- Bihar, Uttar Pradesh, Rajasthan receive under 6%.

- Reflects both:

- Historical outmigration patterns.

- Unequal access to migration-enabling infrastructure like:

-

- Language training

- Skill certification

- Overseas job linkages

- Missing Micro-Level Data on Remittance Usage

-

-

-

- Household-level usage data was not collected in this survey.

- Essential to know whether remittances are:

-

-

- Consumption-smoothing

- Or contributing to long-term savings, investments, or asset creation

Conclusion: Enhancing the Developmental Role of Remittances

- India’s remittance landscape is witnessing a profound structural transformation.

- This shift from Gulf-based low-skilled to AE-based high-skilled flows presents both opportunities and vulnerabilities.

- Policy focus must evolve to:

- Strengthen digital and cross-border financial infrastructure.

- Democratise access to migration pathways across States.

- Ensure remittances are productively channelled for long-term development.

Subscribe to our Youtube Channel for more Valuable Content – TheStudyias

Download the App to Subscribe to our Courses – Thestudyias

The Source’s Authority and Ownership of the Article is Claimed By THE STUDY IAS BY MANIKANT SINGH