RBI’s Decision to Not Cut Rates Amid Trump’s Tariff Shock

RBI’s Decision to Not Cut Rates Highlights Bold Stand Against External Pressure

RBI: On August 6, about a week after imposing a blanket 25% tariff on all Indian imports, U.S. President Donald Trump announced an additional 25% tariff specifically targeting India’s imports of Russian oil, pushing total tariffs on some Indian goods up to 50%.

What is the RBI’s current monetary policy stance and what led to the decision to hold the repo rate at 5.5%?

In its August 2025 bi-monthly Monetary Policy Committee (MPC) meeting, the Reserve Bank of India (RBI) unanimously voted to keep the policy repo rate unchanged at 5.5% and maintained a ‘neutral’ stance, marking a strategic pause after a cumulative 100 basis points cut earlier in 2025, including a front-loaded 50 bps cut in June.

Why this Pause?

- Inflationary Uncertainty: Although headline CPI inflation dropped sharply to 2% in June 2025, the RBI forecasts a resurgence above 4% in Q4 FY26, and close to 5% in Q1 FY27. The temporary disinflation was attributed to volatile vegetable prices and statistical base effects—not structural factors.

- Real Rate Management: With inflation at 2–3%, real interest rates are already accommodative (~1–1.5%). A further rate cut risks reigniting inflation ahead of the festive demand season.

- Transmission Lag: The central bank signalled that the full pass-through of previous cuts—especially the June 50 bps cut—to lending and deposit rates is still ongoing, as highlighted by Crisil and SBI Research.

How are Trump-era US tariffs impacting India’s external sector, and how is RBI responding?

The United States imposed a 25% reciprocal tariff on all Indian goods, citing India’s continued oil imports from Russia. This escalation under President Donald Trump’s protectionist policy revival introduces a new external challenge. Economic Survey 2024-25 had highlighted India’s moderate external vulnerability index due to limited dependence on foreign capital and diversified export markets — now under test due to the US policy turn.

- Impact on India’s Economy:

-

-

- Direct GDP impact is muted, as merchandise exports to the US comprise ~2% of GDP.

- However, indirect risks loom large:

- Capital flow volatility due to deteriorating investor sentiment,

- Disruption in global supply chains,

- Increased uncertainty in trade and investment planning.

-

-

Export Outlook:

-

-

- Merchandise exports expected to contract in FY26,

- Services exports (India’s strength) will grow moderately,

- Current Account Deficit (CAD) projected to remain manageable at 0.9% of GDP (Economic Survey 2024-25).

-

- Buffer Against Shock: India’s $689 billion forex reserves (covering 11 months of imports) offer a strong cushion. RBI Governor Sanjay Malhotra reassured that India remains “a robust, demand-led economy” and contributes 18% to global growth, higher than the US share of 11%.

-

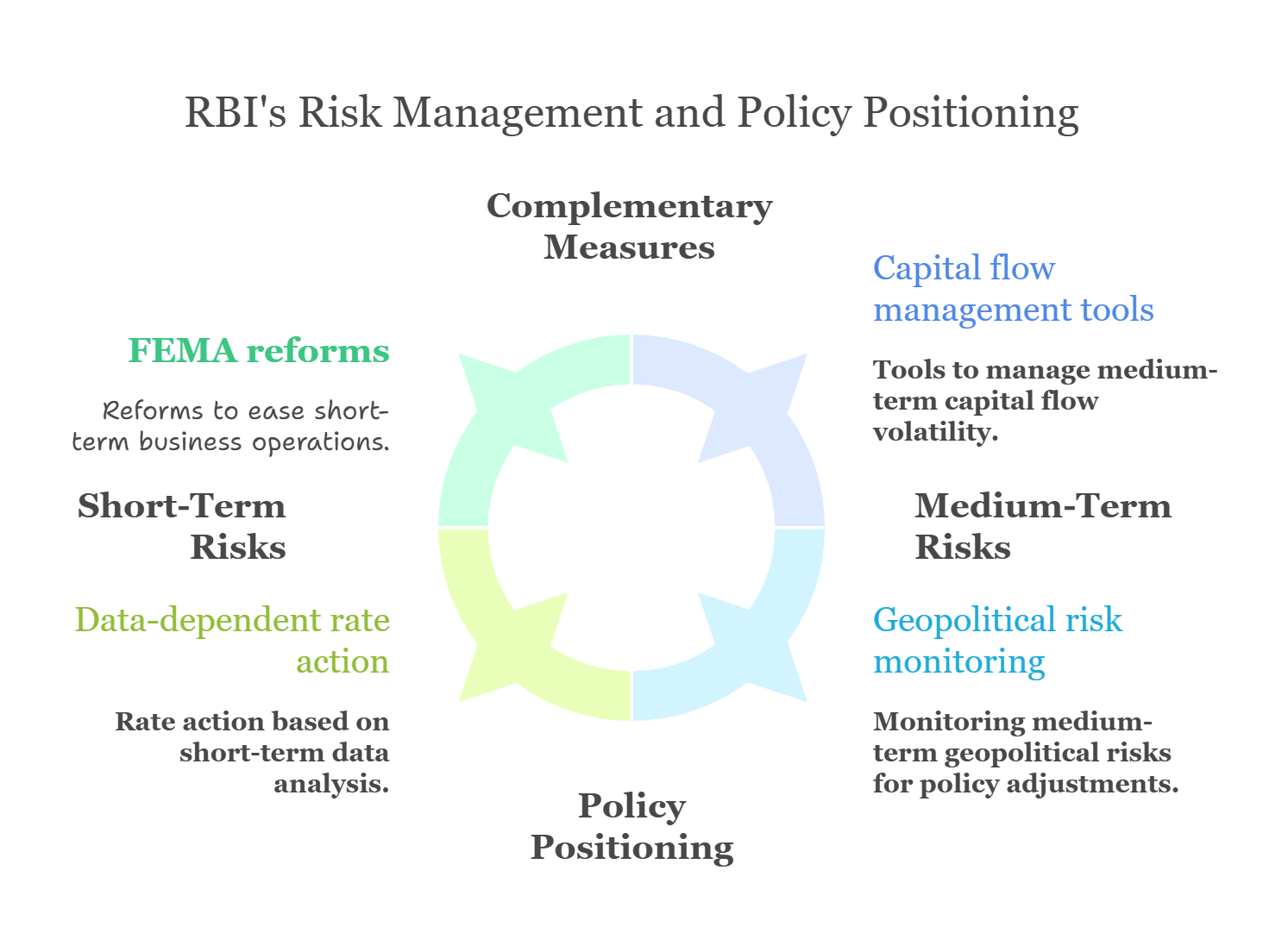

Policy Coordination:

-

- RBI complements monetary policy with regulatory easing under FEMA to facilitate capital flows,

- Strengthening macro buffers to withstand external spillovers.

What does this mean for India’s long-term macroeconomic strategy and structural reforms?

Strategic Takeaways:

- Monetary policy alone is insufficient. RBI’s cautious stance underlines the need for:

- Counter-cyclical fiscal policy,

- Export diversification,

- Strengthening domestic investment cycles.

- Macro-Financial Coordination:

- Public capex must crowd in private investment (Economic Survey 2024–25),

- Export-linked PLI schemes must address non-tariff barriers and logistical bottlenecks,

- Fiscal room must be preserved for shock absorption—a lesson from COVID-19 fiscal management.

Subscribe to our Youtube Channel for more Valuable Content – TheStudyias

Download the App to Subscribe to our Courses – Thestudyias

The Source’s Authority and Ownership of the Article is Claimed By THE STUDY IAS BY MANIKANT SINGH