Out-of-Pocket Health Expenditure in India

Explore why India’s out-of-pocket health spending remains high despite claims of decline, its impact on poverty, and reforms to reduce household burden.

Context

Healthcare in India has long been characterised by high out-of-pocket expenditure (OOPE). Despite official claims that OOPE is declining, ground-level evidence suggests the opposite: households are increasingly bearing the brunt of healthcare costs. This paradox points to deeper issues in data collection, public funding, and the design of India’s health financing systems.

What is Out-of-Pocket Expenditure (OOPE)?

Out-of-Pocket Expenditure (OOPE) refers to direct payments made by households at the point of receiving healthcare services, without reimbursement from the state or insurance. These payments typically cover:

-

Doctor’s fees

-

Medicines and diagnostics

-

Hospitalisation and procedures

-

Emergency care

According to the National Health Accounts (NHA) 2021-22, OOPE constituted 40% of total health expenditure, down from 64% in 2013-14. While this may appear as a major achievement, OOPE continues to dominate household health financing in India.

Globally, the contrast is stark. In most OECD countries, government expenditure is the backbone of healthcare financing, with OOPE accounting for less than 20% of the total. India’s reliance on households reflects weak public investment.

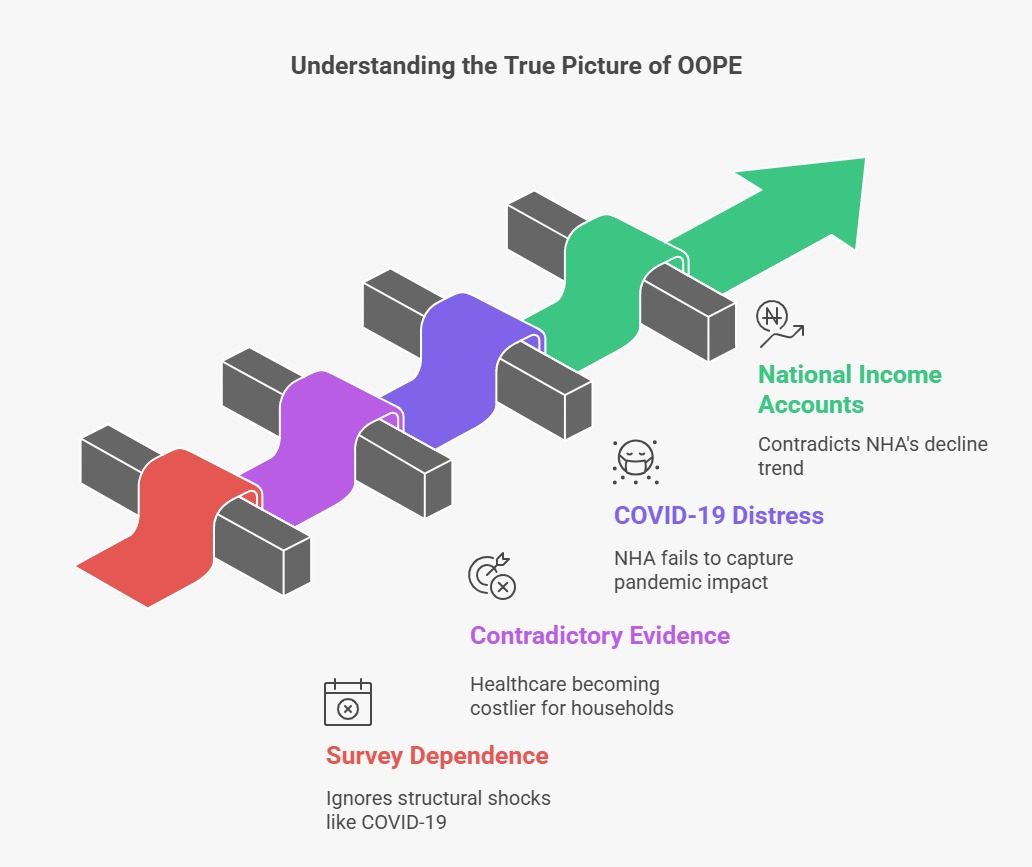

What’s the hard truth behind the decline?

The NHA reports suggest a steep fall in OOPE. However, a closer look reveals methodological and contextual limitations:

1. Survey Dependence

-

NHA relies heavily on the National Sample Survey (NSS) 75th round (2017-18).

-

Later estimates are extrapolations adjusted only for inflation, ignoring structural shocks such as the COVID-19 pandemic.

2. Contradictory Evidence

-

The Consumer Expenditure Survey (CES) 2022-23 shows OOPE as a share of household consumption has risen:

-

Rural: from 5.5% to 5.9%

-

Urban: from 6.9% to 7.1%

-

-

This indicates healthcare has become more expensive, not less.

3. COVID-19 Distress

-

The CMIE Consumer Pyramids Household Survey recorded a V-shaped surge in OOPE during the pandemic, reflecting spikes in costs for hospitalisation, medicines, and oxygen.

-

NHA reports, however, fail to capture this shock.

4. National Income Accounts (NIA) Evidence

-

NIA data shows a steady rise in household health spending as a share of GDP.

-

This directly contradicts NHA’s claims of decline.

5. Reporting Gaps

-

Many households underreport ailments or avoid hospitalisation due to costs.

-

This artificially lowers recorded OOPE in surveys, even as actual financial distress rises.

What are the implications of high OOPE?

High OOPE leads to catastrophic consequences:

1. Poverty Trap

-

The Economic Survey 2018-19 revealed that nearly 6 crore Indians are pushed below the poverty line every year due to health expenditures.

-

This creates a vicious cycle of ill health and poverty.

2. Distress Financing

-

Families borrow money, sell assets, or cut down on essentials like food and education.

-

Women are forced into additional wage work, while children often drop out of school.

3. Regional Inequities

-

As per NFHS-5 (2019-21), states with weak public health infrastructure (e.g., Bihar, Uttar Pradesh) report disproportionately high OOPE.

-

Wealthier states with better facilities show relatively lower OOPE burdens.

4. Global Comparison

-

According to WHO, India’s public health expenditure (1.8% of GDP in 2021-22) is far below the LMIC average (~6%).

-

This underinvestment shifts costs to households, widening inequities.

How Can India Reduce OOPE?

1. Enhance Public Spending

-

The National Health Policy 2017 recommends raising Government Health Expenditure (GHE) to 3% of GDP.

-

This could lower OOPE to 30% of total health expenditure.

2. Strengthen Ayushman Bharat – PM-JAY

-

Coverage: 50 crore people, but many gaps remain.

-

Issues: Low awareness, limited empanelment of private hospitals, and exclusions of outpatient care.

-

Needed: Expanded coverage, timely reimbursements, and greater private sector participation.

3. Expand Primary Care Infrastructure

-

Strengthening Health and Wellness Centres (HWCs) is key to reducing costly hospitalisation.

-

Early detection and outpatient treatment can prevent catastrophic spending.

4. Regulate Prices of Medicines and Diagnostics

-

The National Pharmaceutical Pricing Authority (NPPA) must strictly enforce price caps.

-

Generic medicine availability through Jan Aushadhi Kendras should be scaled up.

5. Improve Health Insurance Penetration

-

Beyond PM-JAY, private health insurance penetration remains low.

-

Affordable, inclusive insurance models are needed for the middle-income segment.

6. Strengthen Data Credibility

-

Robust health expenditure tracking is essential.

-

Integration of NSS, CES, NIA, and CMIE data sources could yield more realistic OOPE estimates.

The Way Forward

India’s healthcare financing system is at a crossroads. While official reports project optimism, independent surveys reveal a growing burden on households. Unless India:

-

raises public spending,

-

strengthens health insurance and primary care, and

-

enforces drug price regulation,

OOPE will continue to push millions into poverty each year.

Reducing OOPE is not just about lowering costs—it is about ensuring equity, dignity, and access to healthcare as a fundamental right.

Subscribe to our Youtube Channel for more Valuable Content – TheStudyias

Download the App to Subscribe to our Courses – Thestudyias

The Source’s Authority and Ownership of the Article is Claimed By THE STUDY IAS BY MANIKANT SINGH