Font size:

Print

Money Laundering Crisis: Powerful Strategies India Must Adopt Now

Money Laundering: Strategic Roadmap for a Safer Financial Future

Context: As per a report in the Rajya Sabha, out of 5,892 money laundering cases taken up by the ED under PMLA since 2015, only 15 have resulted in convictions—highlighting both a low conviction rate and a rising trend in such financial crimes, raising concerns over enforcement effectiveness.

What is Money Laundering and Why is it a Threat to National Security and Economy?

- Money laundering is the process of disguising the illicit origin of money derived from criminal activities such as drug trafficking, terrorism, corruption, or fraud, and projecting it as legitimate.

- Section 3 of the Prevention of Money Laundering Act (PMLA), 2002 defines it as the concealment, possession, acquisition or use of proceeds of crime and projecting them as untainted.

- Recognised as a predicate offence under various UN Conventions: Vienna Convention (1988), UN Convention against Transnational Organised Crime (2000) & UN Convention against Corruption (2003).

-

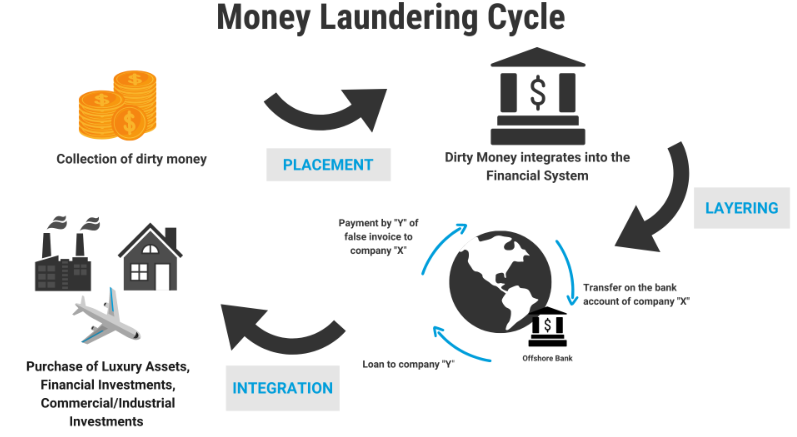

Stages of Money Laundering

-

-

- Placement: Introducing illicit cash into the financial system (e.g., via smurfing or shell firms).

- Layering: Obscuring the audit trail through complex financial transactions (e.g., use of crypto mixers, offshore transfers).

- Integration: Bringing funds back into the legal economy (e.g., real estate, luxury purchases, businesses).

-

-

Threats to National Interest

-

- Terror Financing: Funds insurgency, cross-border terrorism, and extremist activities (FATF notes India as high-risk for ISIL/Al Qaeda-linked financing).

- Economic Instability: Fuels inflation, distorts markets, and undermines monetary policy.

- Loss of Public Revenue: Massive tax evasion reduces funding for welfare schemes.

- Erosion of Institutional Credibility: Hampers investor trust and India’s global reputation.

Who Investigates Money Laundering in India, and What Legal-Institutional Framework Exists?

-

Key Legal Provisions

-

- Prevention of Money Laundering Act (PMLA), 2002: India’s central anti-money laundering law.

- Allows attachment of properties, arrest without FIR, and reversal of burden of proof.

- Defines scheduled offences, prosecution of which can trigger PMLA actions.

- Prevention of Money Laundering Act (PMLA), 2002: India’s central anti-money laundering law.

-

Key Institutions

-

- Enforcement Directorate (ED): Investigates offences under PMLA, empowered to attach assets and file prosecution complaints.

- Financial Intelligence Unit (FIU-IND): Receives, processes, and disseminates suspicious transaction reports (STRs) from banks and financial intermediaries.

- Reserve Bank of India (RBI), SEBI, and IRDAI: Sectoral regulators enforcing AML norms.

-

Judicial Interpretation

-

- Vir Bhadra Singh vs ED (2017): No need for prior FIR to launch PMLA investigation.

- Vijay Madanlal Chaudhary vs Union of India (2022): Upheld stringent PMLA provisions but highlighted procedural safeguards.

-

Global Compliance Mechanisms

-

- Financial Action Task Force (FATF): Intergovernmental watchdog. India is a member and complies with 40 recommendations.

- Egmont Group: India participates in a cross-border financial intelligence exchange.

- Double Taxation Avoidance Agreements (DTAA) with 85+ countries: Aid information exchange, asset tracing, and tax evasion detection.

How is India Combating Money Laundering?

-

National Efforts and Measures

-

-

Regulatory Measures

-

-

-

-

- Know Your Customer (KYC), Enhanced Due Diligence (EDD) norms for financial institutions.

- Mandatory Reporting: STRs, Cash Transaction Reports (CTRs), and cross-border transfers.

- Use of RegTech: AI-based pattern recognition, UBO (Ultimate Beneficial Ownership) tracing, adverse media screening.

-

- Capacity Building: ED modernisation with forensic labs and inter-agency digital platforms. & Specialised AML/CFT training for officials.

- Digital Ecosystem Strengthening:

-

- Digital public infrastructure (e.g., Aadhaar, UPI) enables traceability.

- Jan Dhan-Aadhaar-Mobile (JAM) trinity aids inclusion and surveillance.

-

-

-

International Cooperation

-

- FATF Mutual Evaluation Report (2024):

- Praises India’s high-level technical compliance and beneficial ownership tracking.

- Commends targeted financial sanctions for proliferation financing.

- Applauds improved digital governance and financial inclusion.

- FATF Mutual Evaluation Report (2024):