Font size:

Print

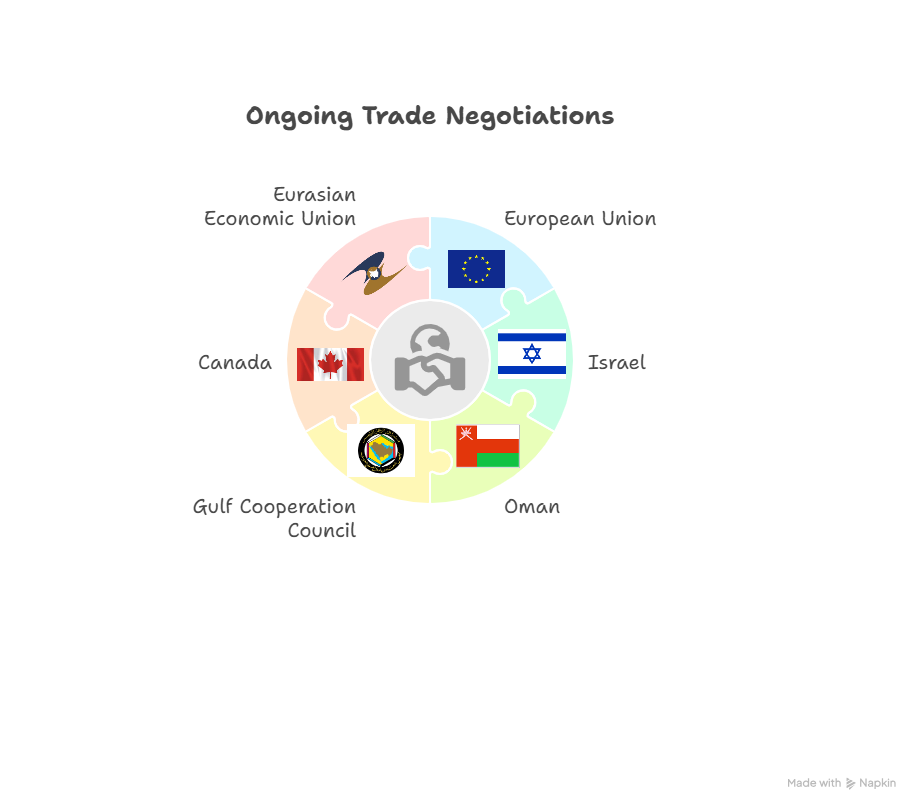

India’s Road to FTAs

Context: Israeli Finance Minister Bezalel Smotrich is visiting India from September 8-10, 2025, to finalise and sign a Bilateral Investment Treaty (BIT), a pact that has concluded negotiations and is ready for signature.

What are the recent Bilateral FTAs signed by India?

India’s FTA strategy has been revitalised post-pandemic, focusing on agreements that align with its new economic strengths and strategic interests.

- Recently Concluded:

-

- India- United Kingdom CETA (2025): Comprehensive Economic and Trade Agreement targets to double the bilateral trade by 2030 from the present $56 bn trade. It also provides duty-free access to 99% of Indian exports.

- India-UAE CEPA (2022): A landmark, wide-ranging agreement that aims to increase bilateral trade in goods to $100 billion and trade in services to $15 billion within five years.

- India-Australia ECTA (2022): An Economic Cooperation and Trade Agreement that provides duty-free access to Indian exports across a wide range of sectors and easier mobility for professionals.

- India-Mauritius CECPA (2021): The Comprehensive Economic Cooperation and Partnership Agreement with Mauritius marks India’s first trade agreement with an African country.

Why are they significant for India?

- Diversification of Supply Chains: Post-COVID-19 and amid US-China tensions, FTAs help India integrate into resilient supply chains (“China Plus One” strategy) and become a global manufacturing hub.

- Market Access for Services: New-age FTAs focus on India’s strengths in services, facilitating the movement of professionals (Mode 4 services) and cross-border data flows, crucial for its IT/ITES industry.

- Attracting Investment: Modern BITs and investment chapters within FTAs provide certainty and protection, attracting Foreign Direct Investment (FDI) into key sectors like manufacturing and infrastructure.

- Strategic Geopolitics: Agreements with partners like the UAE, Australia, and Israel are not just about trade; they solidify strategic partnerships and counterbalance Chinese influence in key regions.

- Boosting Exports: Preferential access to large markets like the EU and UK can provide a massive boost to Indian exporters in textiles, pharmaceuticals, and agricultural products.

What concerns should be taken care of?

- Asymmetric Benefits: Many past FTAs led to a significant increase in imports into India without a proportional rise in exports, worsening the trade deficit with partner countries. Future agreements must ensure a better balance.

- Sensitive Sectors: The influx of cheaper imports can hurt domestic industries (e.g., dairy, agriculture). Strong safeguards, longer tariff phase-out periods, and exclusion lists for sensitive sectors are essential.

- Investor-State Dispute Settlement (ISDS): Older BITs led to India facing several high-stakes arbitration cases. The new model BIT, which the Israel agreement follows, aims to balance investor protection with the state’s right to regulate.

- Non-Tariff Barriers (NTBs): Simply removing tariffs is ineffective if NTBs (complex standards, sanitary norms) persist. FTAs must include strong chapters to address and dismantle these barriers.

- Thorough Economic Impact Studies: Rushing into agreements without a comprehensive sectoral analysis can be detrimental. Rigorous, ex-ante studies are crucial.

What more can be done?

India can look towards Regional Trade Agreements instead of following only bilateral route.

- Re-evaluating RCEP: India walked out of the Regional Comprehensive Economic Partnership (RCEP) in 2019 due to concerns over Chinese dumping and protecting its domestic market. However, it should continuously reassess this position. Engaging with RCEP members through smaller plurilateral agreements or re-joining on terms that include strong safeguards against unfair trade practices and rules of origin is a long-term strategic option.

- Focus on IPEF: Actively shaping the rules in the U.S.-led Indo-Pacific Economic Framework (IPEF), especially in pillars like supply chains, clean energy, and anti-corruption, allows India to integrate into future-oriented trade architectures without traditional market access commitments.

- Strengthening BIMSTEC & IORA: Revitalising engagement with regional groupings like the Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC) and the Indian Ocean Rim Association (IORA) can enhance economic and strategic cohesion in India’s immediate neighbourhood.

- South Asian Integration: Despite challenges, reinvigorating SAFTA (South Asian Free Trade Area) remains vital for regional stability and economic growth.