Font size:

Print

India’s Oil Import Strategy

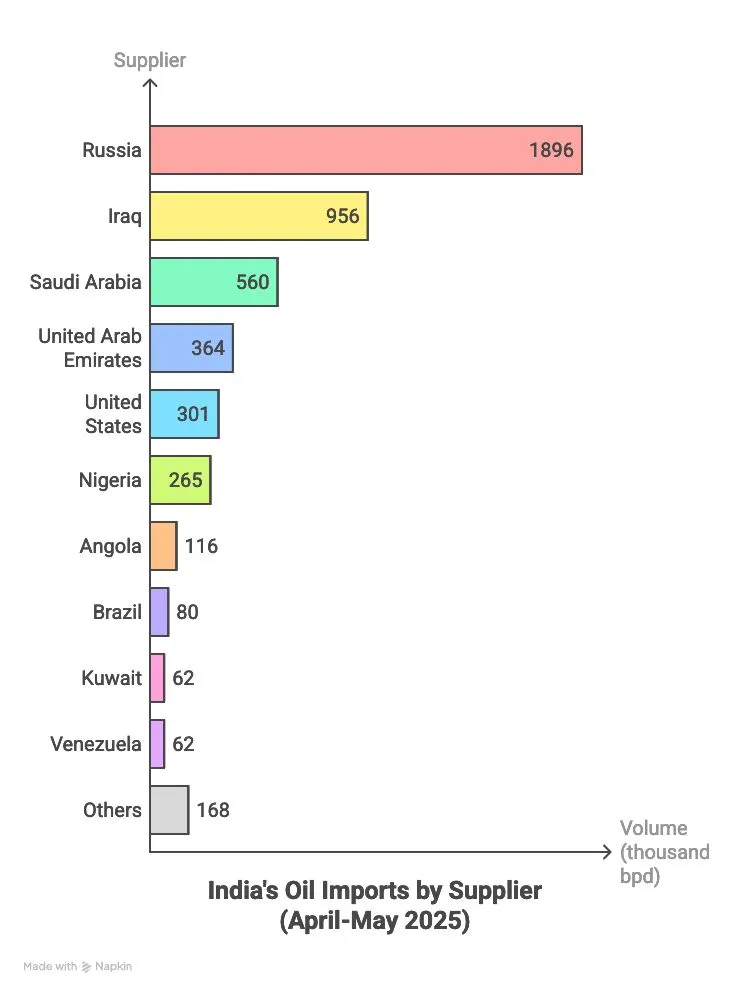

India’s oil imports from Russia, Africa, US and Latin America

Context: With escalating tensions between Israel and Iran and a renewed threat from Tehran to close the Strait of Hormuz, Indian refiners are accelerating efforts to diversify crude oil supplies away from West Asia.

More on News

- Industry experts and data suggest a clear pivot toward Russia, West Africa, the United States, and Latin America, whose shipping routes remain unaffected by potential disruptions in the Persian Gulf.

- The shift comes in response to the U.S. airstrikes on Iranian nuclear sites, after which Iran’s Parliament approved a motion calling for the closure of the Strait.

- While the actual closure remains unlikely, the risk perception has already begun to impact oil prices and shipping strategies globally.

Why the Strait of Hormuz Matters to India

- The Strait of Hormuz is a narrow but vital maritime corridor linking the Persian Gulf with the Gulf of Oman and Arabian Sea.

- According to the U.S. Energy Information Administration (EIA), it is the world’s most critical oil transit chokepoint, with nearly 20% of global oil flows passing through.

- For India — the world’s third-largest oil consumer — the stakes are even higher.

- The country imports over 85% of its crude oil and, according to Indian Express analysis, 45% of May’s crude imports likely passed through this strait.

- Any disruption here could severely impact India’s energy security, trade balance, and inflation control.

Russian Oil Gains Due to Logistics and Pricing

- According to Sumit Ritolia, Lead Research Analyst at Kpler, Russian crude continues to dominate India’s oil imports due to:

-

- Attractive pricing

-

- Non-dollar payment mechanisms

-

- Routes detached from the Strait of Hormuz, such as via the Suez Canal, Red Sea, or Cape of Good Hope

- Additionally, despite Red Sea attacks by Houthi rebels, tankers carrying Russian oil have largely been spared, maintaining stable logistics for Indian refiners.

Energy Prices and Supply Chain Risks on the Rise

- While oil continues to transit the Strait of Hormuz, war risk premiums for cargo ships have surged.

- This has led to a rise in delivered crude prices, particularly for West Asian oil bound for Asia, including India.

- India’s refiners say that even if freight costs increase, they are preferable to the scenario of outright supply disruption.

- Analysts warn that if Iran actually closes the strait, oil prices could soar to $120–130 per barrel, compared to the current $77–78 levels.

Strategic Recalibration and Contingency Planning

- Executives from India’s refining sector confirm they are actively planning for different risk scenarios.

- This includes buying more spot cargoes from outside West Asia, rerouting logistics, and ensuring margin protection.

- While Iran’s oil export infrastructure remains largely intact, a major supply loss — even if indirect — could tighten the global market.

- For instance, if Chinese refiners currently buying Iranian crude are forced to turn elsewhere, it could lead to higher global competition for alternative barrels, thereby impacting India.

- Any significant rise in crude prices will exert inflationary pressure on India, widen the trade deficit, reduce foreign exchange reserves, and weaken the rupee.

- With over 85% energy import dependency, India is especially vulnerable to global oil market volatility.