Font size:

Print

India’s Garment industry

Scale up garment industry

Context: India’s textiles and apparel (T&A) industry has deep historical roots and employs over 45 million people, contributing 2.3% to the national GDP.

More on News

- However, its global trade share tells a more modest story. Despite its scale, India commands only 4.2% of global textile and apparel exports—just $37.8 billion out of $897.8 billion.

- In the apparel segment alone (HS codes 61 and 62), the share drops to 3%, with $15.7 billion in exports out of a global market worth $529.3 billion—a figure that has remained stagnant for two decades.

- India has set an ambitious $40 billion apparel export goal by 2030, but current trends don’t inspire optimism.

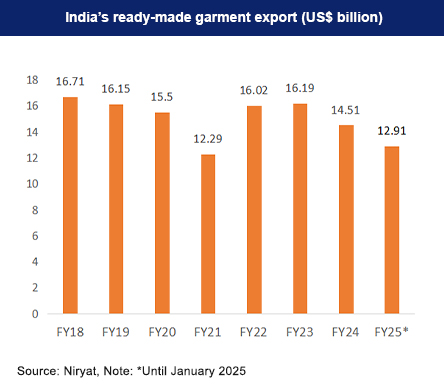

- Exports have been declining at an average annual rate of 2%, and projections based on recent trends show India reaching only $21 billion by 2030, far short of its target.

Core Constraint in India’s Apparel Sector

- Lack of Scale: India’s garment sector is highly fragmented—over 80% of apparel units fall under micro, small, and medium enterprises (MSMEs).

- These units lack the capacity to meet large orders, making India less attractive to global buyers who seek consistency, volume, and rapid delivery timelines.

- Other Countries: In contrast, countries like China, Vietnam, and Bangladesh have built large-scale, export-oriented factories.

- Bangladesh, for instance, leverages single-window buying houses to coordinate large orders across multiple units, streamlining production and delivery.

A Model for Scale and Impact

- A shining example of what scale and vision can achieve in Indian apparel manufacturing is Shahi Exports.

- Founded in 1974 by Sarla Ahuja with a small team of 15 women, the company now operates over 50 factories and three processing mills across eight Indian states, employing over 100,000 workers, 70% of whom are women.

- Shahi’s success lies in its commitment to vertical integration (producing 80% of fabric in-house), professional operations, and a people-first approach—balancing profitability with women’s empowerment and environmental sustainability.

- With over $1 billion in annual revenue, it’s a case study in what India’s garment sector can achieve with the right support.

Policy Reforms to Enable Scale and Global Competitiveness

The Apparel Export Promotion Council (AEPC) was formed in 1978 and is the official body of apparel exporters in India. The primary objective of the council is to promote, advance, increase and develop the export of all types of ready-made garments in India. AEPC supports the apparel industry by providing research and input on FTA, FTP, and bilateral agreements.

To transform India’s garment export potential, we need bold, well-targeted reforms:

- Capital Support for Large-Scale Investments: India’s cost of capital—averaging 9%—is significantly higher than in China (3-3.5%) or Vietnam (4.5%).

- In a sector with razor-thin margins (4-5%), affordable capital is crucial.

- A structured capital subsidy of 25-30%, linked to unit size (e.g., minimum 1,000 machines, as per draft PLI 2.0), could catalyse large-scale investments.

- Additionally, a 5–7 year tax holiday would allow new units to stabilise and become globally competitive.

- Labour Law Flexibility and Cost Incentives: Rigid labour laws and high overtime costs (2x hourly wage vs. ILO’s 1.25x norm) discourage formalisation and scalability.

- Labour makes up 30% of apparel production costs. A radical idea is to channel 25–30% of MGNREGA funds to subsidise wages in labour-intensive garment factories, creating productive employment and boosting competitiveness.

- Scaling skilling initiatives like Samarth—especially for women—can further support this effort.

- Garment-Focused Mega Parks: Of the seven proposed PM MITRA Parks, at least two should be garment-focused, ideally in states like Uttar Pradesh and Madhya Pradesh.

- These states offer low labour costs and face worker migration to southern hubs. Locating manufacturing close to the workforce lowers costs and encourages inclusive regional industrial growth.

- Export-Linked Incentives, Not Just Production-Based: India must rethink its incentive structure.

- Instead of rewarding production alone, incentives should be linked to exports, rewarding firms that succeed in global markets.

- This will encourage quality, innovation, and global competitiveness rather than just volume.

Subscribe to our Youtube Channel for more Valuable Content – TheStudyias

Download the App to Subscribe to our Courses – Thestudyias

The Source’s Authority and Ownership of the Article is Claimed By THE STUDY IAS BY MANIKANT SINGH