Font size:

Print

India’s Emergence as a Global Safe Haven: A Powerful Shift in 2025 Investment Trends

India’s Emergence in 2025: The Strategic Rise as a Reliable Investment Safe Haven

Context: The year 2025 has witnessed a major shift in global capital flows, driven by intensifying US-China trade tensions, geopolitical uncertainties, and evolving global supply chains. In this context, India has emerged as a strategic economic and investment safe haven, benefiting from both internal strengths and external realignments.

Major Shifts in global capital flows

- Investor Realignment: The Asia-Pacific Outlook

- Macroeconomic Fundamentals: A Growth Anchor

- GDP growth estimates for 2025 exceed 6%, among the highest globally.

- Inflation remains moderate at around 4%, signaling sound monetary policy management.

- Robust domestic consumption, unlike China’s export-dependency, offers resilience against global shocks.

- India’s foreign exchange reserves and diversified economic base further enhance investor confidence.

- According to an April 2025 Bank of America survey:

- 42% of Asia-Pacific fund managers are overweight on Indian equities, surpassing Japan (39%) and China (6%)

-

- This reflects growing confidence in India’s:

- Macroeconomic stability

- Strategic neutrality

- Domestic demand and market depth

- Structural Shifts: Supply Chains and PLI-Driven Industrial Growth

- India has gained from the global “China-plus-one” strategy, as multinationals diversify manufacturing bases.

- The Production-Linked Incentive (PLI) Scheme has:

- Boosted manufacturing investments

- Strengthened enterprise confidence

- Key sectors gaining traction: electronics, textiles, and automotive components.

India’s Strategic Positioning in Geopolitical Flux

- Amid the US-China tariff war and recent partial thaw (Geneva talks, May 8, 2025):

- India maintains its position as a non-aligned, dependable economic partner.

- India and the US have agreed to:

- Resolve tariff disputes

- Enhance imports of US energy and defence goods

- Explore a comprehensive trade accord

- India thus emerges as a preferred partner for the West, benefitting from global trade recalibrations.

Competitive Constraints:

- India vs ASEAN Rivals

-

-

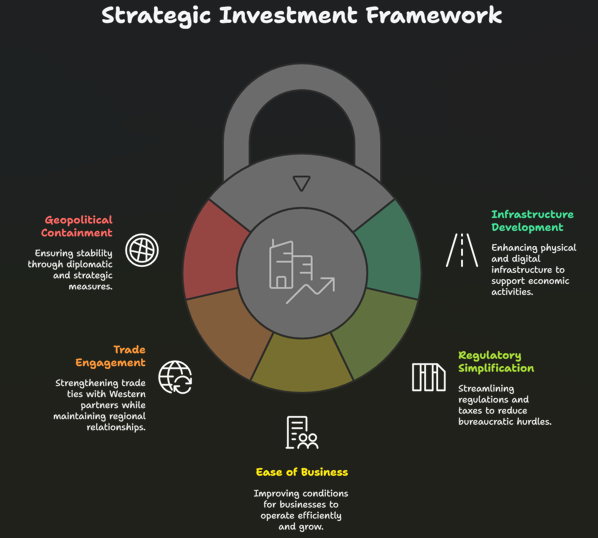

- Despite current momentum, India faces logistics and regulatory hurdles:

- High logistics costs weaken competitiveness.

- Bureaucratic red tape may deter long-term capital.

- Rivals such as Vietnam and Malaysia are better placed in areas like:

- Despite current momentum, India faces logistics and regulatory hurdles:

-

- Port efficiency

- Ease of doing business

-

- India must undertake continuous reforms and infrastructure upgrades to maintain its edge.

- Challenges from China’s Recovery: A Cautious Outlook

- Post-Geneva negotiations have seen investor sentiment toward China begin to soften.

- China has climbed from last to third place in investor rankings.

- A lasting US-China deal may divert some capital back to Chinese markets.

- India must capitalise quickly on the structural supply-chain shift before China regains ground.

- Geopolitical Risks: Impact and Investor Perception

- In April 2025, a Pakistan-sponsored terrorist attack in Kashmir caused 25 civilian deaths.

- Despite fears of escalation: Markets remained stable, reflecting confidence in India’s conflict management.

- Compared to previous decades, investor response is now more measured, thanks to India’s improved crisis-handling and macroeconomic buffers.

- Investor Confidence: From Flashpoints to Fundamentals

-

- India’s limited exposure to export dependence insulates it from global trade disruptions.

- Despite global financial instability and banking turbulence, India’s:

- Equities

- Rupee

-

-

- Remained relatively resilient.

- The confidence is driven by:

-

- Sound fiscal management

- Domestic demand base

- Monetary discipline

- Risks and Vigilance: Internal and External Pressures

- Oil dependency makes India vulnerable to global energy price shocks.

- US interest rate hikes and changing risk appetite could impact capital inflows.

- Internally, challenges include:

- High stock valuations

- Uneven corporate earnings

- Uncertain pace of reforms

- Need for political stability

Conclusion: A Measured Optimism for India’s Investment Future

- India’s rise as a “safe haven” is underpinned by:

- Strong fundamentals

- Strategic neutrality

- Policy-driven growth

- However, to sustain this position, India must:

- Accelerate reforms

- Improve logistics efficiency

- Remain geopolitically balanced

- As global investors recalibrate portfolios in a multipolar trade world, India’s stability, scale, and reform orientation offer a compelling growth narrative—but it must be nurtured through foresight and reformist resolve.