Indian Real GDP vs Nominal GDP Growth Conundrum

India shows strong real GDP growth, yet policy actions signal weak demand. Explore the disconnect between real and nominal GDP, its implications for private consumption, investment, and long-term growth prospects.

Context:

A puzzling dichotomy has emerged over the past few years in the Indian economy. On one hand, official statistics project an image of robust health, with real GDP growth rates consistently exceeding expectations and positioning India as the world’s fastest-growing major economy. On the other hand, policy actions by the government—repeated tax cuts and stimulus measures—seem to be those of an administration fighting to boost a sluggish economy.

What are the Two Conflicting Narratives?

-

The Narrative of Robust Growth (The Real GDP Story):

-

-

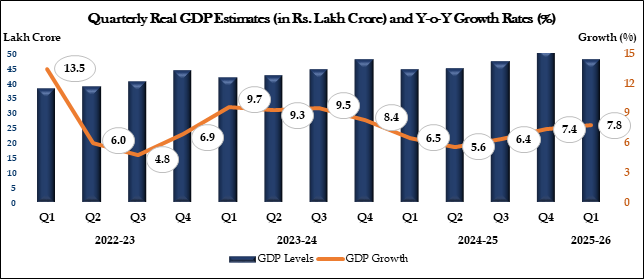

- Strong Headline Numbers: India’s real GDP growth (inflation-adjusted) has been impressive, clocking 7.8% in Q1 (April-June) of the current financial year.

- Global Outperformer: Amidst global economic headwinds, India’s high growth rate is a key pillar of its economic narrative, showcasing resilience and momentum.

- Policy Implication: If the economy is genuinely growing this fast, the natural policy focus should be on controlling inflation and managing supply-side bottlenecks, not aggressively stimulating demand.

-

-

The Narrative of Underlying Weakness (The Policy Action Story):

-

- Successive Fiscal Stimuli: Despite the strong growth data, the government has repeatedly resorted to demand-side interventions:

- Feb 2023: Income tax exemption limit raised to ₹7 lakh.

- Feb 2024: Exemption limit further raised to ₹12 lakh (from a base of ₹2.5 lakh in 2019).

- Recent GST Cuts: The GST Council has reduced rates on several items to spur consumption.

- Policy Implication: These actions are classic tools to boost aggregate demand, suggesting that policymakers perceive a weakness in private consumption, which is the largest component of GDP.

- Successive Fiscal Stimuli: Despite the strong growth data, the government has repeatedly resorted to demand-side interventions:

Resolving the Puzzle: The Critical Role of Nominal GDP

The key to resolving this paradox lies in understanding the difference between Real GDP and Nominal GDP.

- Nominal GDP: The market value of all final goods and services produced in a country in a given period, calculated using current prices. It reflects both the volume of production and the prevailing price level (inflation).

- Real GDP: The value of GDP adjusted for inflation. It reflects only the volume of production and is used to understand true growth in output.

- While Real GDP is the standard for assessing long-term growth, Nominal GDP offers crucial, often more immediate, insights into the economy’s health for several reasons:

- “Actual” Observed Variable: Nominal GDP is closer to the raw data collected. Real GDP is a derived statistic after making sometimes-debatable inflation adjustments.

- Benchmark for Key Variables: Government budgets, tax revenue projections, debt-to-GDP ratios, and corporate earnings are all benchmarked to Nominal GDP growth.

- Better Demand Indicator: Nominal GDP growth more accurately captures the strength of demand in the economy, as it incorporates the price people are actually paying.

- Post-Pandemic Context: The extreme volatility due to COVID-19 lockdowns and the Russia-Ukraine war inflation spike makes nominal trends particularly instructive for identifying a “new normal.”

What the Nominal GDP Data Reveals?

- Growth is Government-Led: In the current Q1, government final consumption expenditure grew at 9.7%, propping up the overall nominal growth. The two main engines of the economy—Private Consumption (PFCE) and Private Investment (GFCF)—grew at rates lower than the overall GDP.

- Significant Deceleration: There has been a sharp slowdown in the nominal growth rates of GDP, PFCE, and GFCF over the last two years.

- Echoes of 2019: The Q1 of 2019-20 also showed decent growth, but it was the high point of a year that ended with a significant slowdown, with real GDP growth slumping below 4%. This highlights how early-year strength can mask underlying weakness.

- Corporate Income Stagnation: The growth in the total income of corporate India aligns with the subdued nominal GDP growth, confirming weak demand conditions.

The Macroeconomic Upshot: A Ceiling on Growth

The divergence between real and nominal GDP growth has profound implications.

- The Historical Formula: Traditionally, India’s growth was understood as: ~12% Nominal GDP = ~8% Real GDP + ~4% Inflation.

- The New Challenge: If nominal GDP growth settles around 8-9%, and inflation remains around 4% (the RBI’s target), the ceiling for real GDP growth becomes just 4-5%. This is far below the 8%+ real growth being reported and the level needed to achieve developed nation status.

A careful examination of Nominal GDP trends and its components (especially private consumption and investment) provides a more nuanced, and perhaps more accurate, picture of the challenges facing the Indian economy—primarily, the need to reignite sustainable broad-based demand.

Subscribe to our Youtube Channel for more Valuable Content – TheStudyias

Download the App to Subscribe to our Courses – Thestudyias

The Source’s Authority and Ownership of the Article is Claimed By THE STUDY IAS BY MANIKANT SINGH