Font size:

Print

India Reforming SEZ Policy

Context: In response to a 50% tariff imposed by the United States on several Indian products, the Indian government is formulating policy changes to protect its local industry. These tariffs have led to a cancellation of export orders, particularly affecting manufacturers in Special Economic Zones (SEZs).

What are Special Economic Zones?

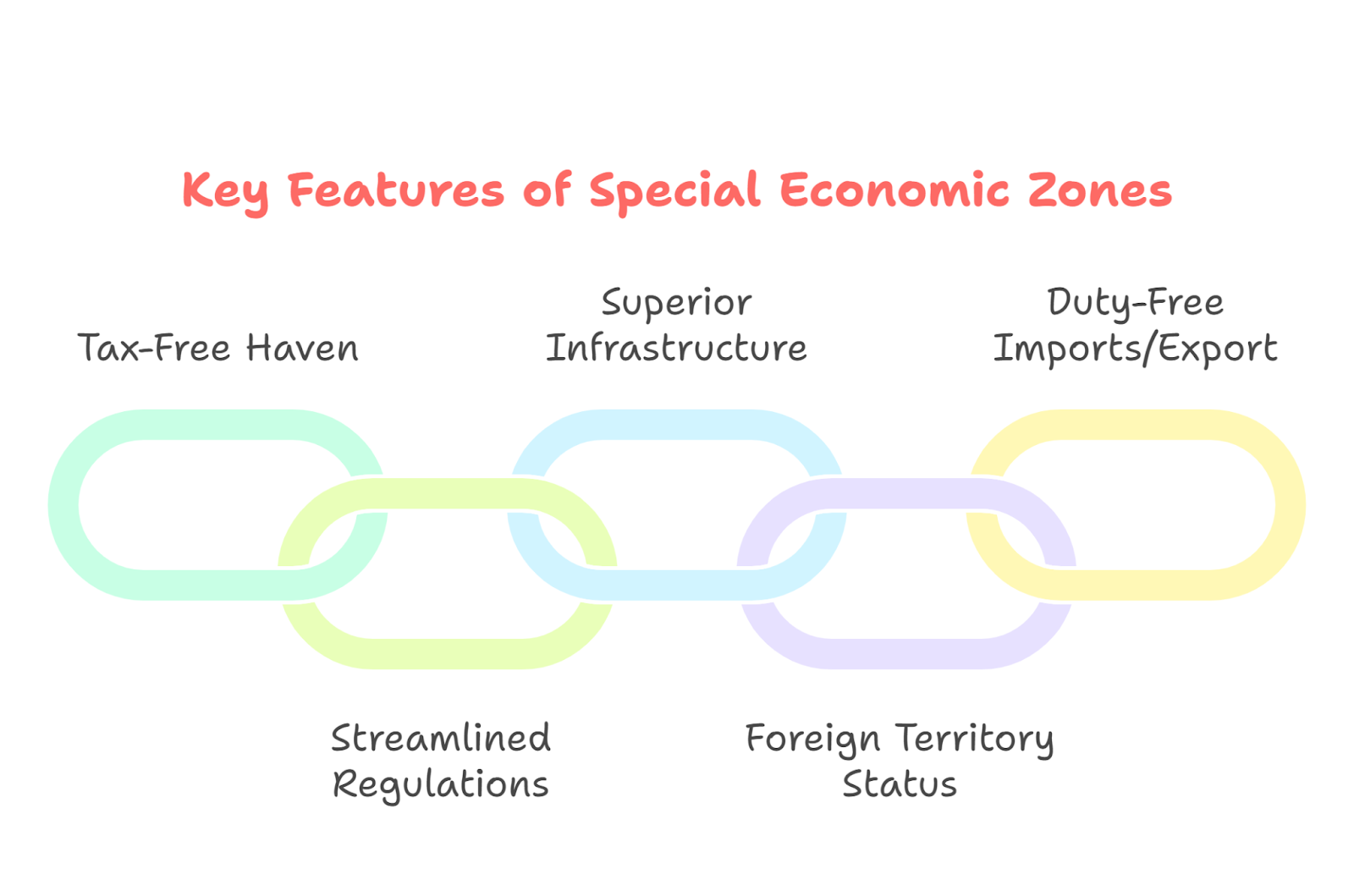

- Special Economic Zones (SEZs) are geographically demarcated regions within a country that are designed to be engines of economic growth.

- They are established with the primary objective of promoting exports by providing an internationally competitive and hassle-free environment for trade and operations.

- SEZs typically offer liberal economic laws, tax incentives, and streamlined regulations that are distinct from the rest of the country’s domestic tariff area.

- By creating a business-friendly ecosystem with superior infrastructure, they aim to attract foreign direct investment (FDI), boost employment, and facilitate the transfer of technology and skills.

How are they recognised in India?

In India, SEZs are established and governed by the Special Economic Zones Act of 2005, which came into effect in February 2006. The legal framework for their recognition is as follows:

- Governing Act: The SEZ Act, 2005, provides the overarching legal framework for the establishment of SEZs.

- Approval Authority: Proposals for setting up SEZs can be made by private developers, state governments, or their joint ventures. These proposals are approved by a two-tier mechanism:

- State Government: The proposal must first be recommended by the respective State Government.

- Board of Approval (BoA): The central government’s Board of Approval, chaired by the Secretary of the Department of Commerce, grants the final formal approval.

- Administrative Control: The Development Commissioner heads the administration of each SEZ and acts as a single-point contact for all matters related to the zone.

- Deemed Foreign Territory: For the purposes of duties and tariffs, units within SEZs are treated as being “outside the customs territory of India.”

How can Special Economic Zones be proved to be prudent and robust in deterring US Tariffs and global trade instability?

- Diversification of Market Risk: The current crisis shows the risk of over-reliance on a single export market (e.g., the US). By allowing easier access to the vast Indian domestic market, the policy helps SEZ units diversify their customer base.

- Maintaining Economies of Scale: By enabling sales domestically, SEZ units can maintain high production volumes.

- Supply Chain Resilience: Supporting SEZ units ensures the survival of integrated manufacturing ecosystems, which is crucial for long-term export strength.

Strategic “Duty Foregone” Model: It ensures a level playing field for domestic producers (as the SEZ product isn’t getting an unfair tax break) while still making the SEZ product price-competitive in the local market.