Income Tax Bill 2025 Empowers Officials with Expanded Search Rights

Income Tax Bill 2025 Brings Sweeping Changes to Tax Enforcement

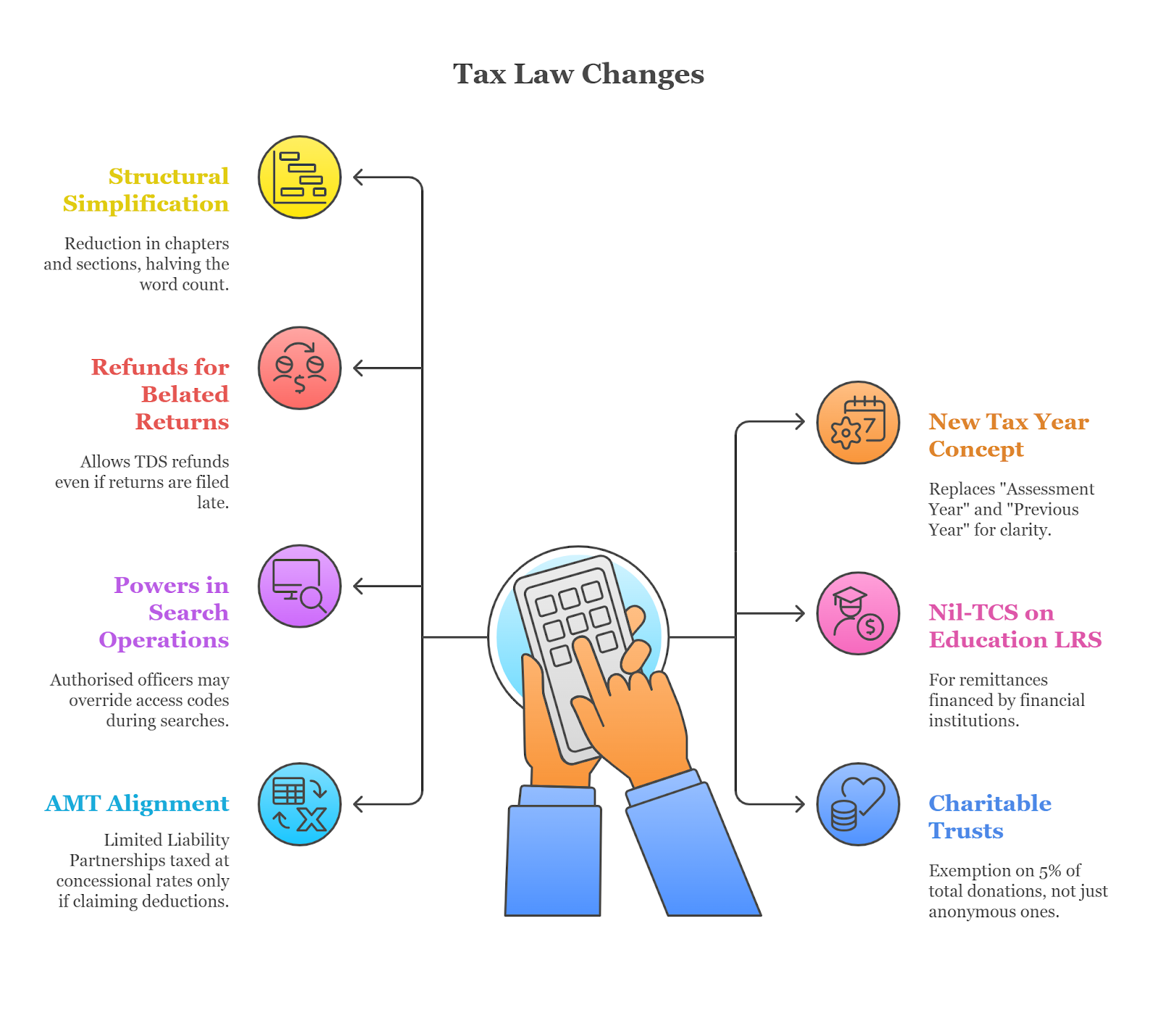

Context: The Lok Sabha has passed the Income Tax Bill (No. 2), 2025, which will replace the 1961 Act from April 1, 2026. The Bill simplifies and shortens the law while expanding officials’ powers to access personal emails and social media accounts of assessees during search operations.

What are the benefits associated with the Income Tax Bill, 2025?

- Legal Clarity & Reduced Litigation – Fewer sections, clearer drafting, and correction of anomalies (e.g., loss set-off rules) reduce interpretational disputes.

- Ease for Taxpayers – Provisions like refunds on belated filings and nil-TDS certificates remove procedural bottlenecks.

- Alignment with Modern Economy – Recognises “virtual digital space” and streamlines provisions for digital-era transactions.

- Encouragement to Investment – Tax exemption to Saudi Arabia’s Public Investment Fund could attract strategic FDI, as in the Abu Dhabi Investment Authority case.

How can the Income Tax Bill help in the ease of doing business?

As per the Economic Survey 2022-23, tax compliance costs and legal uncertainty are major business concerns. The Bill addresses these by:

- Reducing Compliance Complexity – Shorter law, consolidated schedules (18→57 tables, 6→46 formulae) aid navigation.

- Predictability in Taxation – Clear definitions (e.g., “total undisclosed income” in searches) ensure businesses know the taxable base.

- Faster Resolution – Simplified provisions and aligned definitions with allied laws (e.g., MSME Act) reduce disputes.

Example: The re-introduction of inter-corporate dividend deductions for concessional-rate companies mirrors global best practices, supporting India’s ranking in World Bank’s Doing Business indicators on paying taxes.

Subscribe to our Youtube Channel for more Valuable Content – TheStudyias

Download the App to Subscribe to our Courses – Thestudyias

The Source’s Authority and Ownership of the Article is Claimed By THE STUDY IAS BY MANIKANT SINGH