Font size:

Print

FREE-AI

Context: The Reserve Bank of India (RBI) has introduced the Framework for Responsible and Ethical Enablement of AI (FREE-AI) to guide the financial sector in adopting Artificial Intelligence (AI) while managing risks.

What is FREE-AI?

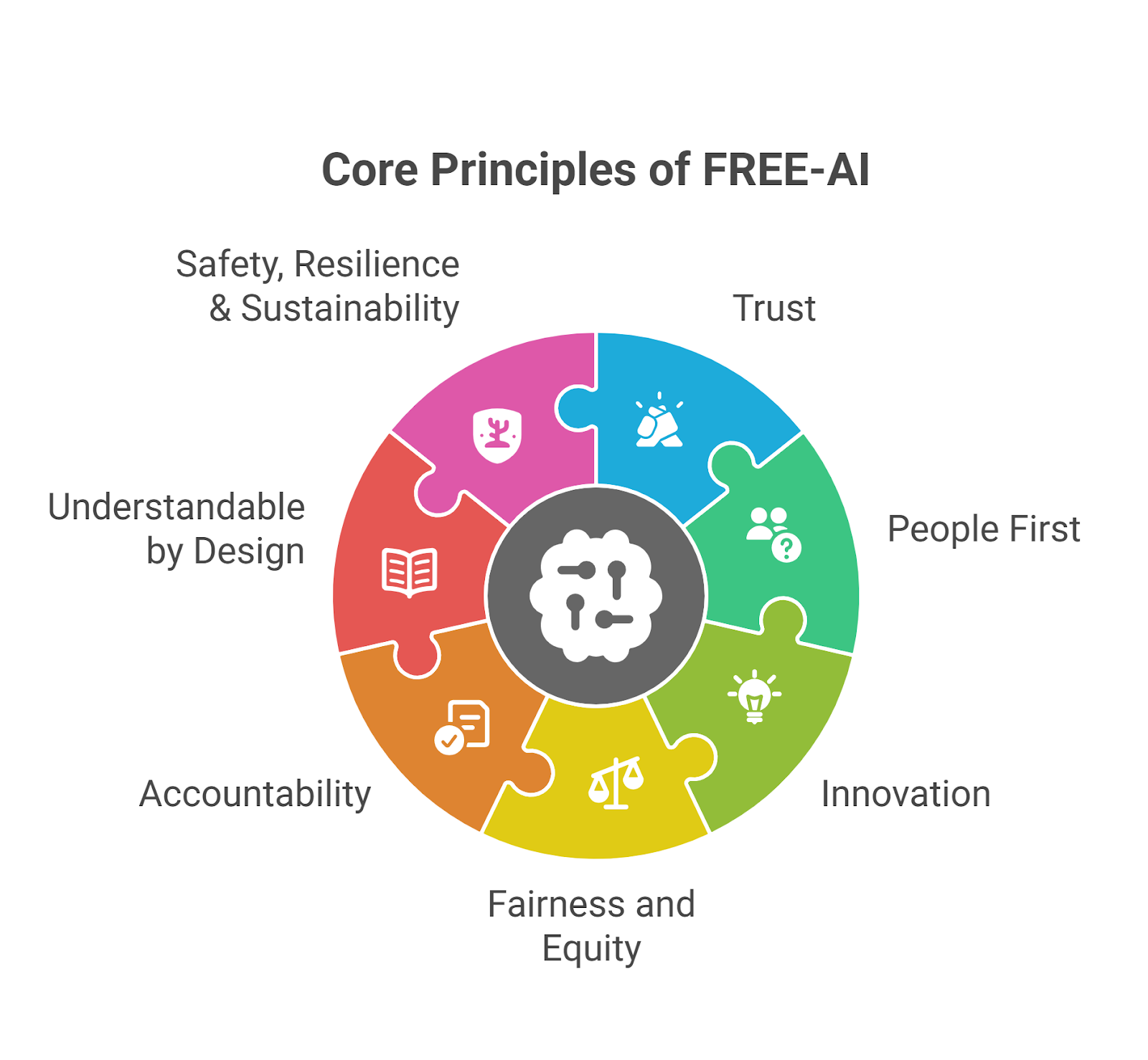

FREE-AI is an RBI-backed framework to promote responsible AI adoption in India’s financial sector. It focuses on:

- Ethical AI Deployment: Ensuring fairness, transparency, and accountability.

- Risk Mitigation: Addressing cybersecurity, bias, and data privacy concerns.

- Innovation Boost: Encouraging AI-driven solutions in banking, insurance, and fintech.

- Objective: To create a secure, inclusive, and efficient financial system powered by AI.

What are the Benefits of AI in India’s Financial Sector?

- Fraud Detection: Real-time monitoring of transactions (e.g., UPI fraud prevention).

- Credit Scoring: AI analyses non-traditional data (e.g., e-commerce history) for loans.

- Customer Service: Chatbots (like HDFC’s EVA) reduce operational costs.

- Risk Management: Predictive analytics for NPAs and market trends.

- Financial Inclusion: AI-driven micro-lending for underserved regions.

What are the Major Challenges?

- Data Privacy: Risk of misuse under India’s Digital Personal Data Protection Act, 2023.

- Algorithmic Bias: AI may discriminate based on gender/region.

- Cybersecurity Risks: AI systems vulnerable to hacking.

- Skill Gap: Shortage of AI-trained professionals in finance.

- Regulatory Lag: Fast-evolving AI may outpace policies.

Subscribe to our Youtube Channel for more Valuable Content – TheStudyias

Download the App to Subscribe to our Courses – Thestudyias

The Source’s Authority and Ownership of the Article is Claimed By THE STUDY IAS BY MANIKANT SINGH