Font size:

Print

Financial Autonomy of Panchayats

Financial Autonomy of Panchayats: A Powerful Step Towards Inclusive Rural Development

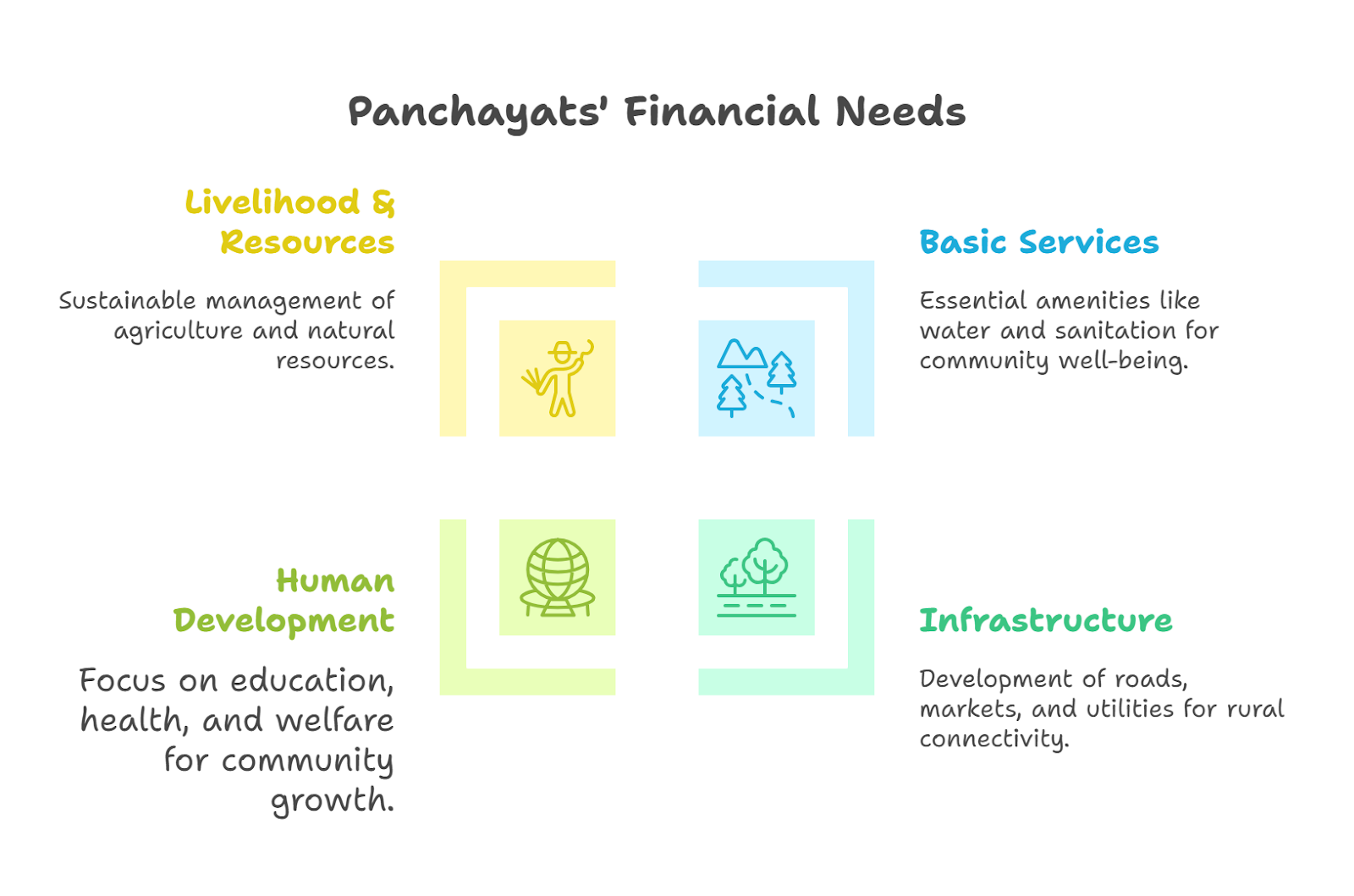

Context: The government is drafting a model framework to help panchayats enhance their own source of revenue (OSR), reducing dependence on central and state funds. A panel under the Panchayati Raj Ministry is preparing a blueprint to guide states and UTs in framing and updating OSR rules for greater financial autonomy at the grassroots level.

What are the major challenges associated with the Own Source of Revenue (OSR) for Panchayats?

The 73rd Constitutional Amendment (1992) empowered Panchayats under Article 243H to levy and collect taxes, duties, tolls, and fees. However, their OSR remains weak due to:

- Absence of OSR rules: Nearly a dozen states/UTs lack regulatory frameworks, leading to under-collection (MoPR, 2025).

- Low contribution to budgets: OSR forms only 10–15% of Panchayat budgets in most states (Economic Survey 2022-23).

- Centralisation of revenue powers: States often retain authority over property tax and natural resource revenues, restricting Panchayat autonomy (NITI Aayog, 2022).

- Capacity deficits: Lack of trained staff to assess, collect, and manage taxes, as highlighted in Odisha and Madhya Pradesh studies.

- Leakages and inefficiencies: Poor digitalisation and weak audit mechanisms reduce transparency in collections (Down to Earth, 2023).

How can this be addressed?

- Devolution Index Insights: The Panchayat Devolution Index (PDI-2024), developed by IIPA, shows wide variations:

-

-

- Top Performers: Karnataka (72.23), Kerala (70.59), Tamil Nadu (68.38) – strong in finances and accountability.

- Low Performers: Jharkhand (27.73), Puducherry (16.16) – weak staffing and financial devolution.

- National Trend: Financial devolution improved modestly from 32.05 (2013-14) to 37.04 (2021-22), still below desired levels.

-

Thus, this variation needs to be bridged.

-

Finance Commission Support

Constitutional basis for fiscal devolution to Panchayats

- Article 243H: Enables Panchayats to levy, collect, and appropriate taxes, duties, tolls, and fees.

- Article 243I & 243Y: Mandates State Finance Commissions (SFCs) every five years to recommend devolution.

- Articles 280 & 275: Finance Commissions at the Union level provide grants to augment Panchayat resources.

Yet, irregular constitutions of SFCs and delays in fund transfers undermine this constitutional intent.

-

- 14th FC: Allocated ₹2.87 lakh crore to local bodies (2015-20).

- 15th FC: Enhanced this to ₹4.36 lakh crore (2021-26), with 60% tied grants for sanitation and drinking water.

-

Case Studies

-

- Kerala’s People’s Plan Campaign: Enabled Panchayats to plan and execute projects independently.

- Karnataka’s Decentralised Financial Management: Ensured timely release of FC funds, strengthening OSR reliance.

-

Other Measures

-

- Digital tax platforms (e-Gram Swaraj).

- Capacity building under Rashtriya Gram Swaraj Abhiyan (2018).

- Strengthened social audits and Gram Sabhas for accountability.