Font size:

Print

Biofuels and Global Energy Transition

Energy Transition and Global South Cooperation

Context: Biofuels are emerging as a critical component of the global energy transition, especially in the Global South.

More on News

- As urbanisation and energy demand rise, fossil fuels remain dominant in transportation, but biofuels offer a lower-carbon alternative.

- Compatible with existing infrastructure and capable of decarbonising hard-to-abate sectors like aviation and shipping, biofuels enhance energy security, reduce emissions, and support rural economies.

Role of Biofuels in Energy Transition

-

Market Dynamics & Growth Potential:

-

-

- Biofuels must triple production by 2030 to meet Net Zero Emissions (NZE) targets.

- The global biofuels market was valued at $113 billion in 2024 and is projected to reach $261 billion by 2034, growing at a 6.9% CAGR.

- Road transport leads in biofuel adoption, while aviation and shipping are emerging sectors, expected to drive 75% of new demand by 2030.

- 58 countries have ethanol blending mandates, and 48 enforce biodiesel requirements.

-

-

Key Producers & Policies:

-

-

- U.S., Brazil, EU, India, and Indonesia (80% of global supply).

- Brazil leads with 21% of transport energy from biofuels, supported by RenovaBio, a carbon credit-based policy.

- India aims for 20% ethanol blending by 2025, doubling its 2022 levels.

- Indonesia targets 50% biodiesel blending by 2028, leveraging palm oil resources.

-

-

Investment & Innovation:

-

- Private sector investments are shifting toward drop-in fuels (e.g., renewable diesel, biojet, biomethane).

- Brazil’s Raízen is investing $2 billion in second-gen ethanol and biogas plants.

- India is funding 5,000 compressed biogas plants and hydrogen-methane pilot projects.

Challenges & Solutions

-

Cost & Feedstock Competition:

-

-

- Biojet and biomethane remain 2x more expensive than fossil fuels.

- Food vs. fuel debate: Expansion risks deforestation and biodiversity loss.

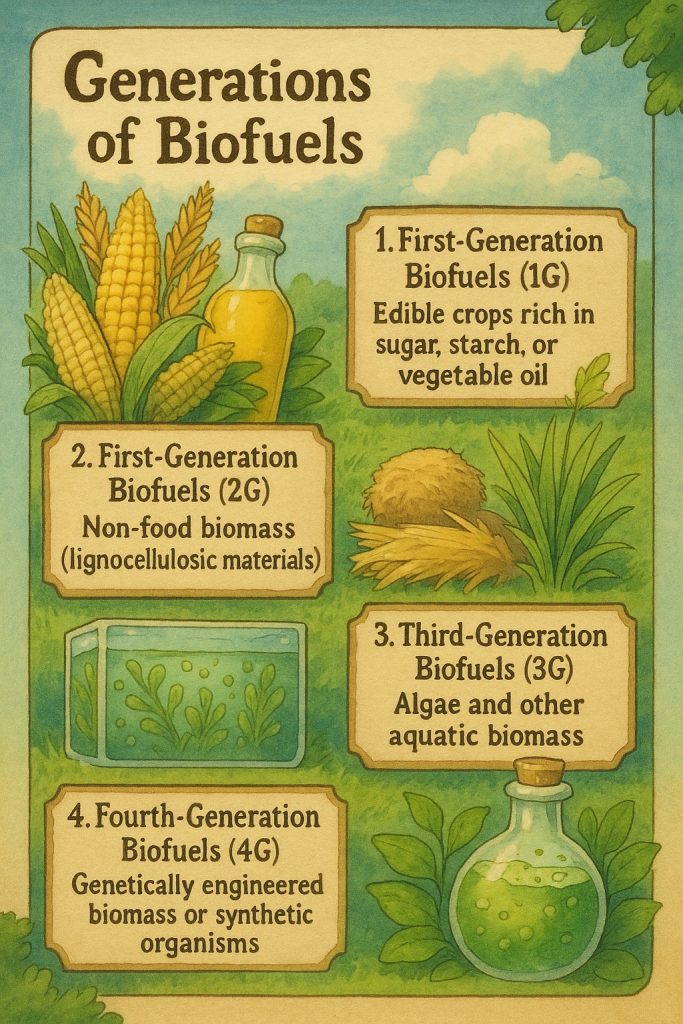

- Solution: Invest in second- and third-generation biofuels (e.g., algae, agricultural waste).

-

-

Policy & Regulatory Gaps:

-

-

- Blending mandates and sustainability certifications (e.g., ISCC) are crucial.

- Emerging economies need stronger incentives to match U.S. and EU policies.

-

-

Global Collaboration:

-

- The Global Biofuels Alliance (GBA) fosters cross-country learning and technology transfer.

- Brazil, India, and Indonesia serve as models for sustainable biofuel policies.

Strategic Roadmap: Building a Resilient Biofuel Future

To unlock the full potential of biofuel production in India, a multi-pronged strategy is essential:

- Regulatory Strengthening: Standardise ethanol transport regulations across states. Expand permissible feedstock categories, especially untapped agricultural waste (estimated at ~500 million tonnes annually).

- Institutional Reform: Establish inter-ministerial working groups. Implement a single-window approval system for biofuel-related projects.

- Economic Incentives: Promote subsidies for non-traditional feedstocks like lignocellulosic biomass. Ensure timely farmer payments to encourage feedstock supply.

- Infrastructure Development: Expand ethanol blending facilities and storage capacity. Invest in dedicated pipelines and rail-based transport networks. Create regional biofuel production clusters to optimise logistics and resource use.

- Technology & R&D Investment: Support the development of second- and third-generation (2G & 3G) biofuels, which offer higher energy yields and lower emissions. Foster public-private partnerships (PPPs) to accelerate technology deployment.