Insolvency and Bankruptcy Code (IBC) in India

Supreme Court upholds JSW Steel’s plan for BPSL, reaffirming IBC’s role in asset revival, recovery, and credit growth despite delays and challenges.

Context:

In a significant reversal, the Supreme Court recently upheld the National Company Law Appellate Tribunal (NCLAT) order approving JSW Steel’s resolution plan for Bhushan Power and Steel Ltd (BPSL).

More on News

- This decision overturned the Court’s own earlier verdict from May 2, which had quashed the plan on rigid procedural grounds and ordered the liquidation of the company.

- The initial verdict had created widespread uncertainty among investors, as it undermined a long-drawn resolution process that had the buy-in of the Committee of Creditors (CoC).

- The final judgment prioritises the substantive objectives of the Insolvency and Bankruptcy Code (IBC)—preserving companies as going concerns and maximising asset value—over minor procedural lapses. It acknowledges that JSW Steel had successfully turned the loss-making BPSL into a profitable entity, and forcing liquidation at this stage would have vitiated the very purpose of the IBC.

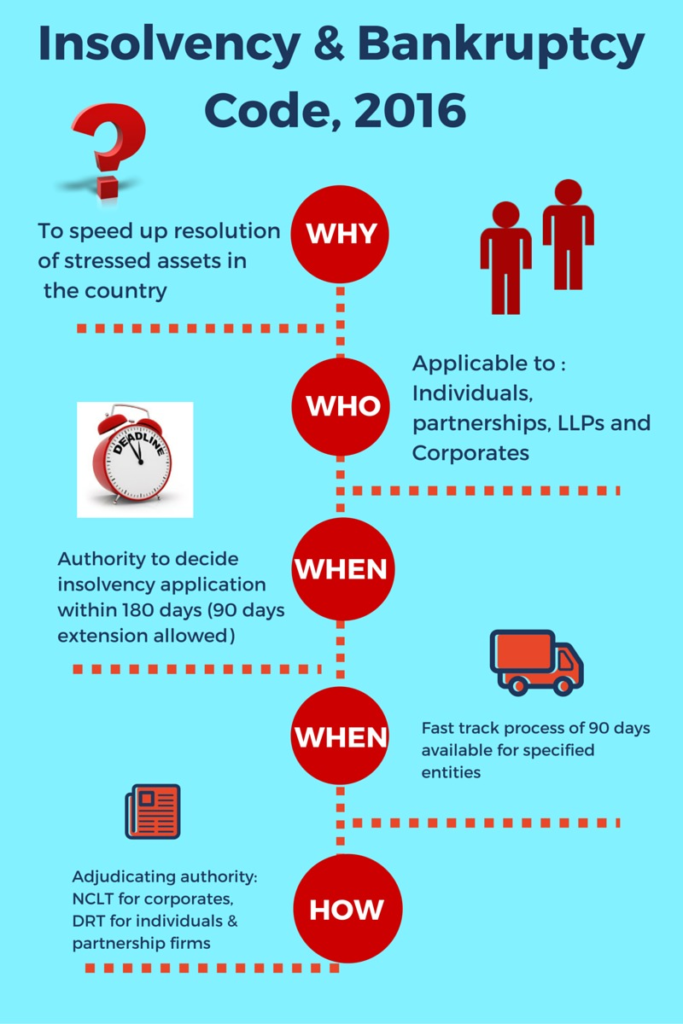

What is the Insolvency and Bankruptcy Code (IBC)?

The Insolvency and Bankruptcy Code, 2016, is a comprehensive legislation that consolidates and amends the laws relating to reorganisation and insolvency resolution of corporate persons, partnership firms, and individuals in a time-bound manner. Its key objectives are:

- Maximisation of Value of Assets: To ensure the revival of the corporate debtor and maximise the value for all stakeholders.

- Promotion of Entrepreneurship: To provide a clear, speedy, and efficient framework for insolvency resolution, thereby encouraging entrepreneurship.

- Availability of Credit: To strengthen the credit market by ensuring timely resolution and improving recovery rates for lenders.

- Time-Bound Process: The Code mandates a strict timeline (originally 180 days, extendable to 330 days) for the completion of the Corporate Insolvency Resolution Process (CIRP).

- Shifting Control from Promoters to Creditors: It introduces a creditor-in-control regime, where the Committee of Creditors (CoC) approves the resolution plan.

What have been its achievements?

The IBC is widely regarded as a landmark reform in India’s economic landscape. Its major achievements include:

- Significant Improvement in Recovery Rates: Compared to previous mechanisms like SARFAESI and DRTs, the IBC has led to a substantially higher recovery rate for financial creditors.

- Behavioural Change among Borrowers: The threat of losing control of their company has compelled many delinquent promoters to settle defaults outside of the IBC process, a phenomenon known as the “deterrence effect.”

- Formal Resolution Framework: It has replaced the earlier ad-hoc and fragmented system with a unified, transparent, and institutionalised process.

- Revival of Companies: It has facilitated the successful resolution and revival of several large, stressed assets (e.g., Essar Steel, Bhushan Steel), saving jobs and productive capacity.

- Development of a Secondary Market: The IBC has spurred the growth of a market for distressed assets in India, attracting both domestic and international investors.

What factors are responsible for its limited success?

Despite its successes, the IBC has faced several challenges that have limited its effectiveness:

- Inordinate Delays: The most critical challenge is the significant deviation from the stipulated timelines. Cases often take much longer than 330 days due to a heavy backlog at the NCLT/NCLAT and frequent judicial interventions by higher courts.

- Operational Creditors’ Treatment: Operational creditors (like suppliers and vendors) often receive a very small share of their dues compared to financial creditors, raising concerns about fairness.

- High Litigation: The process is often mired in litigation from erstwhile promoters, unsuccessful bidders, or other stakeholders, leading to delays and uncertainty.

- Infrastructure Bottlenecks: The adjudicating authorities (NCLT benches) are understaffed and overburdened, leading to a growing pile of cases.

- Liquidation Over Resolution: A large number of CIRPs still end in liquidation rather than resolution, which is often a sub-optimal outcome for all stakeholders.

- Haircuts for Lenders: While recovery rates are better, banks still have to take significant haircuts in many cases.

What reforms are needed?

To realise the full potential of the IBC, the following reforms are necessary:

- Strengthening Adjudicating Infrastructure: Increasing the number of NCLT and NCLAT benches and appointing more members with specialised expertise to clear the backlog.

- Reducing Judicial Interference: Establishing clear precedents to minimise appeals and litigation that cause delays, especially at the Supreme Court level for commercial matters.

- Focus on Pre-Packs: Promoting pre-packaged insolvency resolutions for MSMEs, which can be a faster and less costly mechanism.

- Clarity on Cross-Border Insolvency: Enacting and implementing a robust framework for cross-border insolvency to handle cases with international assets and creditors.

- Encouraging Early Identification: Developing a framework for early identification and resolution of financial distress before the situation becomes irreparable.

- Streamlining the CoC’s Role: Providing clearer guidelines to the CoC to balance the interests of all stakeholders, including operational creditors, while maintaining commercial wisdom.

Subscribe to our Youtube Channel for more Valuable Content – TheStudyias

Download the App to Subscribe to our Courses – Thestudyias

The Source’s Authority and Ownership of the Article is Claimed By THE STUDY IAS BY MANIKANT SINGH