Font size:

Print

Tropical Forest Forever Facility: Brazil’s Bold Market-Led Climate Finance Innovation

Context: Brazil’s push for the Tropical Forest Forever Facility (TFFF) at the upcoming COP30 in Belém comes at a time when climate finance gaps remain stark—with forest protection needs estimated at $460 billion annually by 2030 but current flows far below this.

What is a Tropical Forest Forever Facility (TFFF)?

Key design features

- Payments fixed at $4/hectare annually, adjusted for inflation.

- At least 20% of funds earmarked for Indigenous Peoples and Local Communities (IPLCs).

- Monitoring through satellite imagery, with canopy and deforestation thresholds.

- Designed to complement REDD+, not replace it, by focusing on standing forest protection without generating carbon credits.

- The Tropical Forest Forever Facility (TFFF), proposed by Brazil for COP30 in Belém, is a blended finance mechanism aimed at raising $125 billion for tropical forest conservation.

- It functions through the Tropical Forest Investment Fund (TFIF), pooling concessional contributions from high-income countries and philanthropies (20%) with institutional and sovereign wealth fund investments (80%).

- The capital will be invested in liquid financial assets (e.g., green bonds, US treasuries), and the returns will finance performance-based payments to Tropical Forest Countries (TFCs) for conserving standing forests.

What is its significance?

- Bridging the Finance Gap: According to WWF (2025), global forest protection needs $460 billion annually by 2030; current finance is less than one-tenth of this. TFFF, the largest-ever dedicated forest fund, could channel about $4 billion annually to tropical forest nations.

- Recognition of Standing Forests: Unlike REDD+, which rewards avoided deforestation, TFFF incentivises high-forest, low-deforestation regions like the Congo Basin.

- Support to IPLCs: If implemented, IPLCs could access nearly $800 million annually, almost triple existing climate-related ODA flows (OECD data).

- Partnership Model: Framed as an investment rather than aid, it reduces dependence on volatile donor grants and creates long-term financial predictability.

- Brazil’s Leadership: With 12% of global forest cover, Brazil positions itself as a climate finance innovator and forest diplomacy leader ahead of COP30.

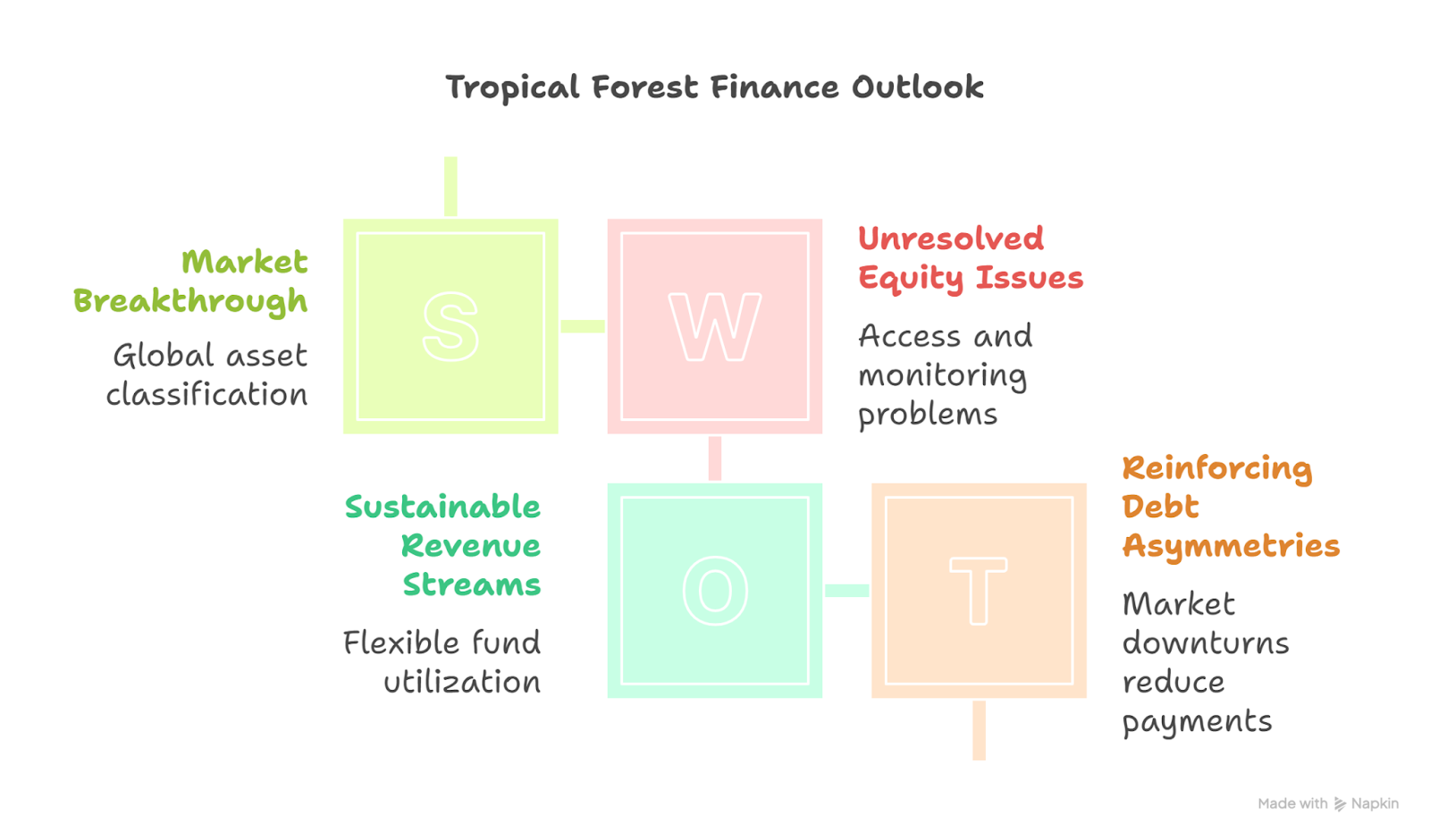

What challenges does the market-driven approach of the TFFF pose?

- Dependence on Credit Ratings: Returns hinge on TFIF’s rating by agencies like Fitch or Moody’s. Lower ratings could raise borrowing costs, reducing net payments to forest nations.

- Debt Burden on Global South: As highlighted by Third World Network (2025), much of TFFF’s revenue arises from investments in developing economies, meaning funds flow back from the very countries it intends to support—reinforcing structural inequalities of the global financial system.

- Volatility of Capital Markets: Payments to TFCs risk reduction during downturns, undermining conservation incentives.

- Governance Concerns: Historically, IPLCs have received <1% of climate ODA (OECD). Ensuring that 20% of TFFF funding reaches them without bureaucratic leakages is uncertain.

- Definitional Disputes: The reliance on canopy thresholds (20–30%) risks excluding countries with naturally sparse forests, echoing past conflicts seen under the EU Deforestation Regulation.