Font size:

Print

Reforming India’s Insolvency Framework

Context: The Insolvency and Bankruptcy Code (IBC), 2016, was a landmark reform aimed at resolving corporate insolvency efficiently while balancing creditor and debtor rights.

What is the Insolvency and Bankruptcy Code (IBC)?

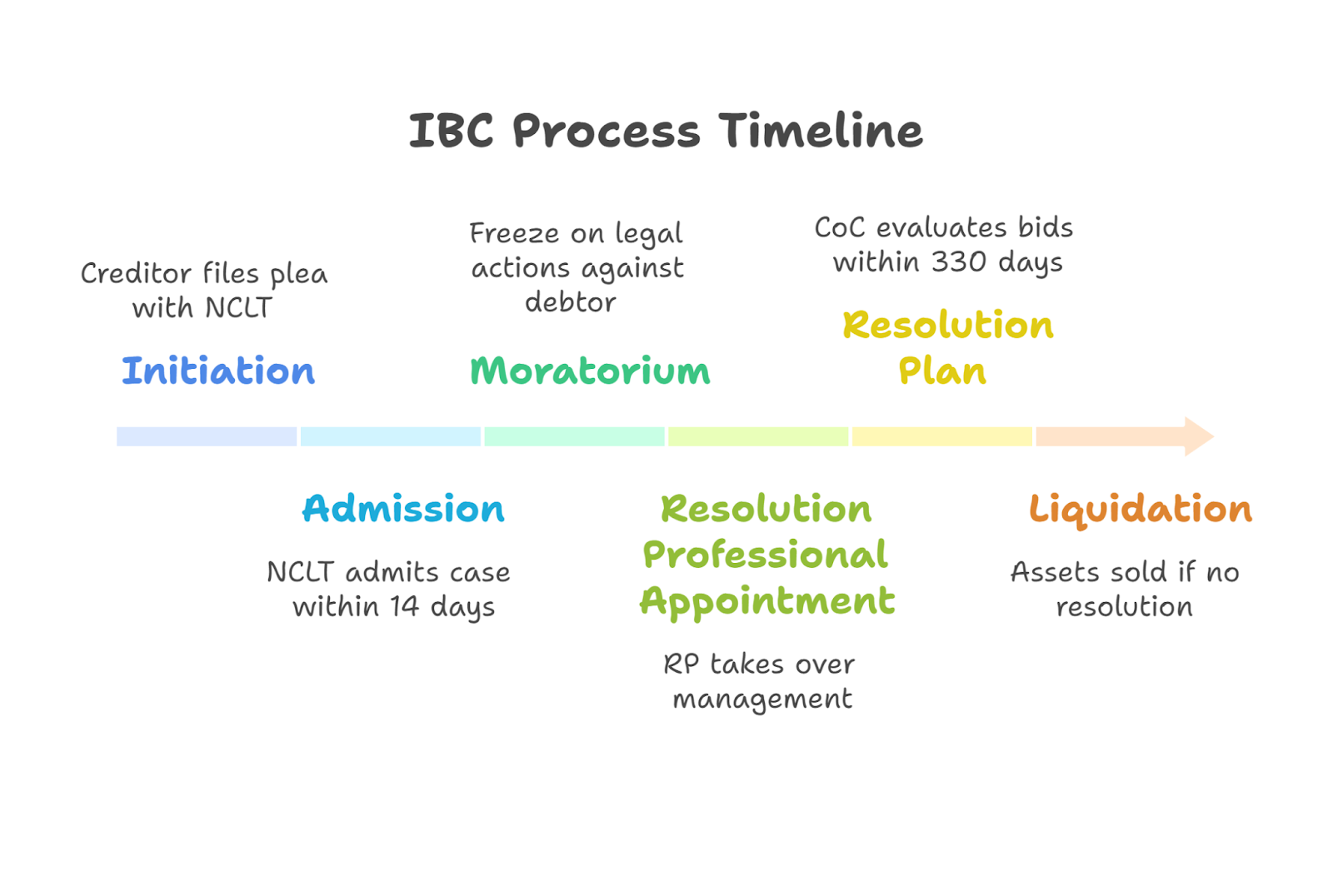

- The IBC is a unified legal framework for resolving insolvency and bankruptcy cases in India.

- Enacted in 2016, it consolidates multiple laws and establishes a time-bound process for debt resolution.

- Key objectives include:

- Maximising asset value for creditors.

- Promoting entrepreneurship by allowing viable businesses to restructure.

- Improving India’s Ease of Doing Business ranking by ensuring faster resolutions.

- The Insolvency and Bankruptcy Board of India (IBBI) regulates the process, while the National Company Law Tribunal (NCLT) adjudicates cases.

What Are the Major Concerns Associated with the IBC?

Despite its successes, the IBC faces challenges:

- Delays: Average resolution time exceeds 600–700 days vs. the mandated 330 days.

- Low Recovery Rates: Only ~32% of claims are recovered (2024 data).

- Litigation Bottlenecks: Frequent appeals at NCLAT and the Supreme Court (e.g., Essar Steel case).

- Operational Creditors’ Plight: They often receive negligible payouts.

- Role of Resolution Professionals (RPs): Inefficiencies and conflicts of interest.

- Exclusion of Key Sectors: Real estate and MSMEs face unique hurdles.

How Are the New Reforms Going to Address These Concerns?

The 2024 Amendment Bill proposes:

- Creditor-Led Out-of-Court Settlements

- Allows creditors and debtors to negotiate without NCLT intervention, speeding up resolutions.

- Retains debtor management under board supervision (unlike current RP takeover).

- Faster Admission of Cases

- Default alone suffices for CIRP initiation, reducing procedural delays.

- Protection for Leased Assets

- Excludes leased assets (e.g., aircraft) from moratorium, aligning with the Cape Town Convention to reduce leasing costs.

- Group Insolvency & Cross-Border Cases

- Streamlines resolution for business groups and overseas assets.

- Strengthening IBBI’s Role

- Enhances regulatory oversight to curb RP inefficiencies.

What is the Way Forward?

- The Parliamentary Committee should ensure stakeholder consultation.

- Introduce grace periods for debtors (like US Chapter 11).

- Limit judicial interference unless there’s a grave miscarriage of justice.