Font size:

Print

Small Finance Bank (SFB)

Context: AU Small Finance Bank received in-principle approval from the Reserve Bank of India (RBI) to transition from a Small Finance Bank (SFB) to a Universal Bank.

Universal Banks are financial institutions licensed by the Reserve Bank of India to offer a comprehensive range of services—commercial banking, investment banking, and more—under one roof.

What are Small Finance Banks (SFBs)?

- Small Finance Banks (SFBs) are specialised banks in India established with the objective of advancing financial inclusion by offering basic banking services—such as accepting deposits and lending—to segments not adequately served by traditional banks.

- Their primary focus is on smaller business units, micro and small industries, marginal farmers, and unorganised sector entities, especially in rural and semi-urban regions.

How are SFBs determined in India?

- Regulation: SFBs are regulated by the Reserve Bank of India (RBI), functioning under the Banking Regulation Act, 1949 and RBI Act, 1934.

- Eligibility: Resident individuals/professionals with 10 years’ experience in banking and finance, as well as corporates and societies owned by residents, can establish SFBs.

- Existing NBFCs, MFIs, and Local Area Banks owned and managed by residents are also eligible.

- Minimum Capital: Minimum paid-up capital required is ₹200 crore; must be registered as a public limited company under the Companies Act, 2013.

- Mandates: At least 25% of branches must be located in unbanked rural areas.

- They must allocate at least 75% of their Adjusted Net Bank Credit to Priority Sector Lending and ensure that 50% of their loan portfolio consists of loans up to ₹25 lakh.

- Promoter Shareholding: Initially, promoters must hold at least 40% of paid-up equity, which is to be reduced to 26% within 12 years.

- Operational Guidelines: SFBs cannot set up subsidiaries for non-banking activities and must maintain a capital adequacy ratio of 15%.

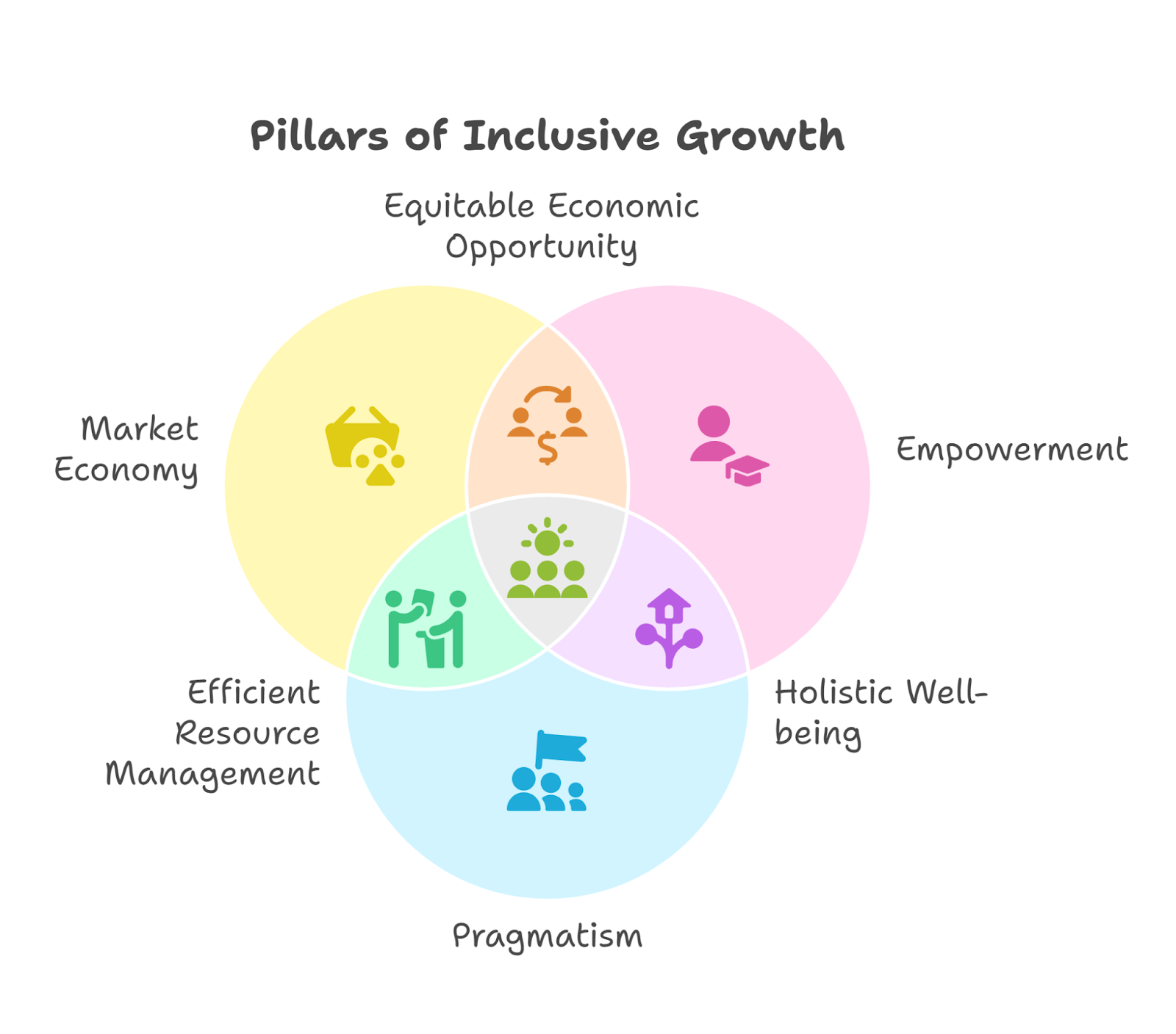

How do SFBs help in bolstering inclusive growth?

- Expanding Financial Services Access: According to the World Bank, over 190 million adults in India remain unbanked.

- Affordable Credit: AU Small Finance Bank disbursed ₹42,000 crore in FY23, with ~40% going to MSMEs and agriculture.

- Focused Priority Lending: By mandating a high percentage of lending to the priority sectors, SFBs align financial growth with social impact, fostering inclusive development and reducing economic disparity.

- Promotion of Savings Culture: By offering savings and deposit products, SFBs encourage the habit of savings among low-income groups, increasing the financial resource base and contributing to GDP growth.

What are the benefits of conferring “Banking” status?

- Access to Deposit Insurance: Depositors’ funds in SFBs are insured under the Deposit Insurance and Credit Guarantee Corporation, enhancing public trust and financial security.

- Capital Raising & Public Listing: As banks, SFBs can raise capital more easily, and public listing is mandated for larger entities, improving governance standards.

- Offering a Wide Range of Services: Banking status allows SFBs to offer comprehensive financial services, including savings/current accounts, fixed/recurring deposits, issuing debit/credit cards, and digital banking facilities.

- Regulatory Oversight & Trust: Banking status brings stringent RBI oversight, ensuring transparency, accountability, and safer operations, attracting deposits and investor confidence.

- Participating in Government Programmes: Only banks can directly participate in many government initiatives for credit, infrastructure funding, financial inclusion, and payment systems—expanding their impact on society.

- Inclusivity and Economic Growth: The secure environment created by regulated banks helps mobilise savings, provide credit, and enhance economic growth through better resource allocation.

Subscribe to our Youtube Channel for more Valuable Content – TheStudyias

Download the App to Subscribe to our Courses – Thestudyias

The Source’s Authority and Ownership of the Article is Claimed By THE STUDY IAS BY MANIKANT SINGH