Font size:

Print

Vegetable Oil Security in India: Bold Moves to Cut Import Dependence

Vegetable Oil Security: India’s Strategic Push for Self-Reliance

Context: In an unusual shift, Indian importers have purchased a record 150,000 metric tons of soyoil from China, driven by steep discounts amid a supply glut, undercutting traditional suppliers like Brazil and Argentina.

What are vegetable oils, and where are they generally obtained from?

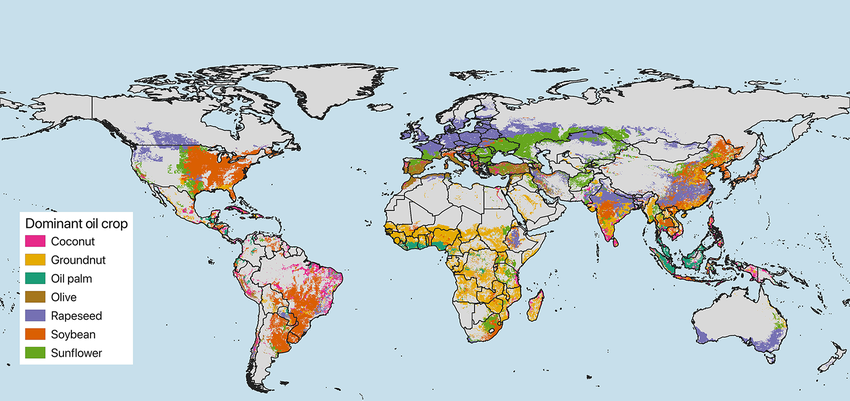

- Vegetable oils are plant-derived fats used mainly for cooking, food processing, biodiesel, cosmetics, and pharmaceuticals. They are extracted from oil-rich seeds or fruits such as:

- Soybean (soyoil) – majorly from Argentina, Brazil, China, USA

- Palm oil – primarily from Indonesia and Malaysia

- Sunflower oil – mainly from Russia and Ukraine

- Mustard, groundnut, sesame, and cottonseed oils – largely grown in India

- Canola (rapeseed) oil – from Canada and Europe

- Globally, India imports vegetable oils from:

- Palm oil: Indonesia & Malaysia (via Strait of Malacca)

- Soyoil: Argentina, Brazil, recently China

- Sunflower oil: Russia & Ukraine

Why is it necessary to enhance the indigenous production of vegetable oils?

- Ballooning Import Dependency: As per Economic Survey 2024-25, India imports ~66% of its total edible oil requirement (~14–15 million tonnes annually), making it one of the largest importers globally. This creates: Trade deficits, Volatility in prices & Strategic vulnerability to global shocks (e.g., Ukraine war, Indonesia’s palm oil export ban in 2022)

- Supply Chain Disruptions: Recent events like Ukraine-Russia conflict impacted sunflower oil supplies, Export restrictions by Indonesia (2022) on palm oil & China’s record soybean oil stockpile in 2025 led to dumping at discounted rates. Such dependencies undermine India’s food security and economic sovereignty.

- Global Price Volatility: Vegetable oil prices are tied to global crude, freight rates, and weather. Example: In May–July 2025, India imported 150,000 tonnes of discounted soyoil from China, breaking its norm of sourcing from Brazil and Argentina , due to price advantages and faster delivery.

- Nutritional and Rural Livelihood Concerns: Domestic oilseeds like mustard, sesame, groundnut , Suit Indian diets, Create rural employment, Support crop diversification and climate resilience.

What measures have been taken to augment vegetable oil production in India?

- National Mission on Edible Oils – Oil Palm (NMEO-OP), 2021

-

-

- Aim: Boost domestic palm oil production to reduce reliance on imports.

- Outlay: ₹11,000 crore for 5 years.

- Focus: North-Eastern states and Andaman & Nicobar Islands.

- Components: Planting material support, assured price mechanism, R&D.

-

- Price and Import Duty Rationalisation: To manage price surges, the government cut import duties on crude and refined oils multiple times (2021–2024), and recently reviewed tariff structures to avoid excessive imports during oversupply (e.g., 2025 soyoil import from China).

- Supported through PM-Annadata Aay Sanrakshan Abhiyan (PM-AASHA): Under Price Support Scheme (PSS) and Price Deficiency Payment (PDP), oilseed farmers receive minimum support prices (MSPs) or compensation for price gaps.

- Oilseed Crop Diversification Initiatives

Case Study: Rajasthan’s Mustard Revolution

- According to Economic Survey 2023-24 & NABARD Reports Rajasthan has emerged as India’s mustard powerhouse due to hybrid varieties and government procurement.

- Yields rose from 950 kg/ha (2015) to 1,400+ kg/ha (2023).

- Helped reduce local edible oil demand-supply mismatch.

-

- Inclusion of mustard, sesame, sunflower, and soybean in National Food Security Mission

- Promotion of intercropping systems and climate-resilient varieties

- As per Down To Earth , Bundelkhand farmers switching to mustard from wheat saw better returns with less water stress.

- Public-Private Partnerships & FPOs

-

- NABARD and private players are promoting Farmer Producer Organisations (FPOs) for oilseeds

- Contract farming in palm oil initiated with guaranteed buyback clauses