Font size:

Print

Employment Linked Incentive (ELI) Scheme

Cabinet approves Employment-Linked Incentive scheme to support formal job generation

Context: To boost formal employment generation, especially in the manufacturing sector, the Union Cabinet has approved the Employment Linked Incentive (ELI) Scheme.

More on News

- Announced in the Union Budget 2024–25, the scheme has a total outlay of Rs 99,446 crore and aims to create 3.5 crore jobs over a period of two years.

- The scheme forms a key part of the Prime Minister’s Employment and Skilling Package, which has a broader outlay of Rs 2 lakh crore.

- It focuses on improving employability, providing wage support, and ensuring social security, especially for new entrants into the workforce.

What Are the Key Features of the ELI Scheme?

-

- Part A (Support for First-Time Employees): This component targets first-time salaried workers registering with the Employees’ Provident Fund Organisation (EPFO). It offers a wage subsidy of up to Rs 15,000 in two instalments:

- First instalment: After 6 months of continued employment.

- Second instalment: After 12 months, along with the completion of a financial literacy programme.

- Eligibility: Employees with monthly salaries up to Rs 1 lakh.

- A portion of the incentive will be deposited in a savings instrument or deposit account, encouraging a culture of saving.

- Part B (Incentives for Employers to Generate Jobs): Part B focuses on encouraging employers to create and retain new jobs:

- Employers will receive monthly incentives of up to Rs 3,000 per additional employee for two years.

- For manufacturing sector jobs, incentives will be extended to the third and fourth years.

- Part A (Support for First-Time Employees): This component targets first-time salaried workers registering with the Employees’ Provident Fund Organisation (EPFO). It offers a wage subsidy of up to Rs 15,000 in two instalments:

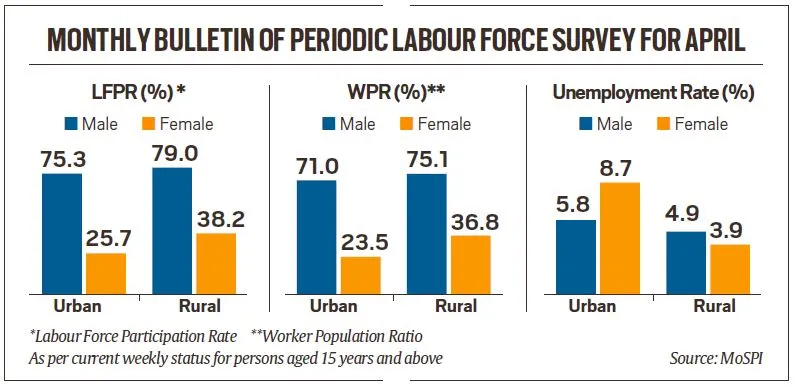

- Incentive Structure by EPF Wage Slab:

-

-

- Up to Rs 10,000: Rs 1,000

- Between Rs 10,001 – Rs 20,000: Rs 2,000

- Between Rs 20,001 – Rs 1,00,000: Rs 3,000

-

- Minimum Hiring Requirement:

-

- Employers with fewer than 50 employees: Hire at least 2 additional workers.

- Employers with 50 or more employees: Hire 5 or more.

Who Will Benefit From the ELI Scheme?

- Out of the 3.5 crore jobs expected to be created, approximately 1.92 crore will be first-time employees (under Part A). Remaining jobs will be created through employer-led job generation under Part B.

- Both components of the scheme are aimed at increasing the share of formal employment, improving wage security, and supporting the growth of labour-intensive industries, particularly manufacturing.

How Will the ELI Scheme Be Implemented?

- The scheme will be implemented between August 1, 2025, and July 31, 2027.

- Payments to employees under Part A will be made through Direct Benefit Transfer (DBT) into their bank accounts.

- Incentives to employers under Part B will be paid into PAN-linked business accounts.

- The scheme will be monitored by the Ministry of Labour and Employment in collaboration with EPFO.

Why Is the ELI Scheme a Game-Changer for Employment in India?

- The ELI Scheme aligns with India’s formalisation of the workforce and employment generation goals.

- It offers direct wage support for new entrants, while incentivising job creation by businesses in key sectors.

- The emphasis on financial literacy, saving habits, and sustained employment makes it more than just a subsidy scheme—it’s a structured employment framework.