Font size:

Print

India’s Crude Oil and Natural Gas Consumption: A Growing Energy Security Risk

India’s Crude Oil and Natural Gas Consumption Crisis: Why Import Dependency Hurts

Context: India’s energy security challenge has become more pressing in the backdrop of renewed geopolitical tensions in West Asia. In June 2025, Brent crude prices surged to $81.40 per barrel, following US airstrikes on Iranian nuclear facilities—raising fears of a potential disruption in oil flows through the Strait of Hormuz.

What is the current status of India’s crude oil and natural gas consumption and production?

- Crude Oil: In FY2025, India consumed 265.7 million tonnes of crude oil but produced only 28.7 million tonnes, resulting in an import dependence of around 89%.

- Natural Gas: India’s total natural gas demand stood at 195.4 million metric standard cubic meters per day (mmscmd), while domestic production was only 97.5 mmscmd—leading to an import dependency of 50%.

Why is India so heavily dependent on oil and gas imports?

- Rising Energy Demand: Economic growth, urbanisation, and industrial activity are driving up energy needs. India ranks third globally in oil consumption, after the USA and China.

- Limited Domestic Resources: Domestic reserves are either limited, underexplored, or uneconomical to extract in large volumes.

- Stagnant Domestic Output: Crude oil production has remained stable or marginally declining over recent years.

- Slow Green Energy Transition: Alternatives such as renewables or hydrogen are still in transition and need time to scale up.

Where does the risk lie in India’s energy import routes?

- Strait of Hormuz: 45% of India’s crude and 54% of LNG imports pass through this narrow maritime chokepoint. Any disruption (e.g., Iran blocking the Strait) can sharply reduce supply and push up prices globally.

- It handles 20 million barrels/day, about 20% of global oil trade.

- 83-84% of oil and LNG passing through the Strait is bound for Asia.

- Other Routes:Imports are also routed via the Suez Canal, Cape of Good Hope, and alternative sea lanes, but these are longer and more costly.

When is the energy security risk most acute?

- During geopolitical conflicts: For example, in June 2025, Brent crude hit $81.40/barrel after US airstrikes on Iranian nuclear facilities, exposing India’s vulnerability to Middle East tensions.

- In case of sudden supply shocks: India has only 74 days’ worth of oil in combined strategic and commercial inventories—insufficient in case of a prolonged disruption.

How is India responding to the risk of import dependence and route vulnerability?

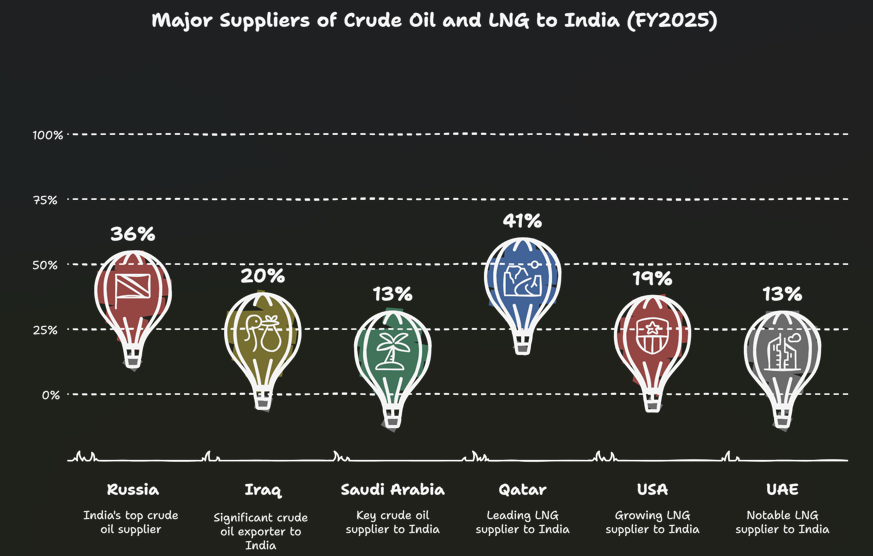

- Diversifying Sources: Expanding purchases from Russia, Brazil, US, and West Africa reduces over-reliance on Middle Eastern suppliers.

What is the likely future trajectory of demand and import dependency?

- Crude Oil Demand: Expected to grow by 3-4% in FY2026. Domestic production is likely to stay flat, keeping import dependence high.

- Natural Gas Demand: Anticipated to grow by 4-6% in FY2026. Domestic production will rise marginally to 100 mmscmd, still leaving 52% of demand to be met through LNG imports.

- Strategic Reserves: India has built Strategic Petroleum Reserves (SPR) in three locations—Visakhapatnam, Mangaluru, and Padur—with additional capacity in the pipeline.

- Boosting Domestic Production: While difficult in the short term, efforts are underway to incentivise upstream oil and gas exploration.

- Expanding Renewables: India targets 500 GW of non-fossil fuel capacity by 2030 under its Nationally Determined Contributions (NDCs).

Why is risk diversification so important now?

- Price Volatility: Even if supply isn’t disrupted, speculative price surges (due to tensions or blockades) can heavily impact India’s import bill and inflation.

- Import Bill Stress: India’s oil import bill rose to $137 billion in FY2025, up from $133.4 billion in FY2024—a growing burden on forex reserves.

- Strategic Vulnerability: With 88% of crude and 45% of natural gas consumption dependent on imports, India is exposed to global shocks.