India’s Inflation and Unemployment

Inflation falls but not unemployment

Context: India’s inflation fell to 2.8% in May 2025, earning the RBI praise for economic management. However, rising unemployment and slowing GDP growth paint a more troubling picture.

What are the Impacts?

- Inflation Drops, But Unemployment Rises: According to the Periodic Labour Force Survey (PLFS), India’s unemployment rate rose from 5.1% in April to 5.8% in May 2025—even as inflation cooled.

- Decline in Economic Growth: India’s growth rate slowed from 9.2% in FY 2023–24 to 6.5% in FY 2024–25, as per the provisional estimates released by the National Statistical Office (NSO).

- Sector-wise, only agriculture showed a strong performance, while other sectors—excluding Public Administration—registered a slowdown.

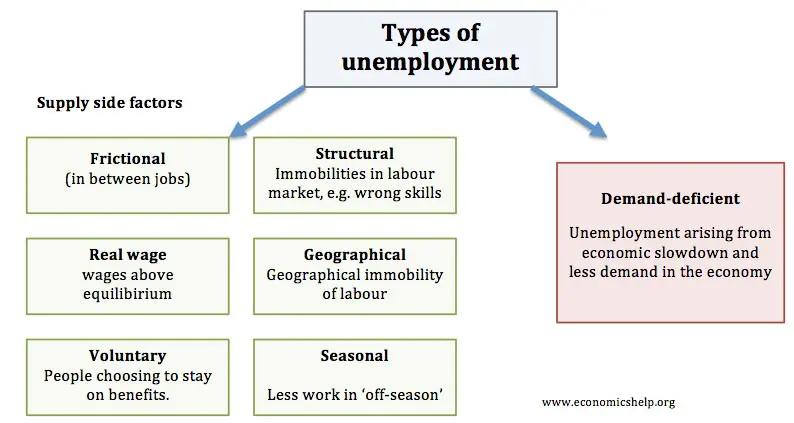

- Drivers: The shift in inflation appears to be structurally linked to supply-side improvements, especially in agriculture.

Inflation

Inflation is the rate at which the general level of prices for goods and services rises over a given period, leading to a decrease in the purchasing power of money. Headline inflation refers to the total inflation within an economy, measured by the overall change in the price of a broad basket of goods and services, including volatile items such as food and energy. It reflects the actual rise in the cost of living that consumers experience and is the most commonly reported inflation figure in the media. Core inflation is a measure of the long-term trend in the price level that excludes items with highly volatile prices, mainly food and energy. By removing these components, core inflation provides a clearer view of underlying, persistent inflationary pressures in the economy.

What is RBI’s Role in Inflation Control?

The Reserve Bank of India (RBI) is the primary institution responsible for managing inflation in India. Its main goal is to maintain price stability while supporting economic growth. The RBI achieves this through a range of monetary policy tools and frameworks:

- Repo Rate Adjustments: The repo rate is the rate at which RBI lends money to commercial banks.

- Reverse Repo Rate: By increasing the reverse repo rate, RBI attracts banks to park their excess funds with the central bank, absorbing surplus liquidity from the system and thus controlling inflation.

- Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR): RBI can increase the CRR (the percentage of deposits banks must hold with the RBI) and SLR (the percentage of deposits banks must maintain in liquid assets), both of which reduce the money available for banks to lend, thereby tightening the money supply and containing inflation.

- Open Market Operations (OMO): RBI buys or sells government securities in the open market. Selling securities absorbs excess liquidity, while buying injects liquidity. During inflation, RBI sells securities to reduce money supply.

- Inflation Targeting: Since 2016, RBI has formally adopted an inflation targeting framework, aiming to keep inflation within a 2–6% band, with a target of 4%.

- The Monetary Policy Committee (MPC) meets bi-monthly to assess inflation trends and adjust policy accordingly.

- Market Stabilisation Scheme (MSS): RBI issues government bonds under the MSS to absorb excess liquidity, further helping to control inflation.

What are the Challenges Faced by RBI in Controlling Inflation?

- Balancing Inflation and Growth: Raising interest rates can control inflation but may also slow down economic growth and increase unemployment. Striking the right balance is a persistent challenge, especially when external shocks or domestic slowdowns occur.

- Weak Policy Transmission: The effect of RBI’s policy rate changes on the broader economy is often delayed or muted due to structural issues in India’s financial system, making inflation control less effective and predictable.

- Supply-Side Shocks: Many inflationary pressures in India stem from supply-side factors such as volatile food and fuel prices, which are less responsive to monetary policy. RBI’s tools are more effective against demand-driven inflation than supply shocks.

- Data and Structural Constraints: Accurate and timely macroeconomic data is sometimes lacking, complicating policy decisions. Structural issues like inadequate infrastructure also limit the effectiveness of monetary interventions.

- Exchange Rate Volatility: Monetary policy actions can lead to fluctuations in the rupee’s value, impacting imports, exports, and inflation, especially in an open economy.

- Managing Expectations and Credibility: Public skepticism due to a history of high and variable inflation can undermine the effectiveness of inflation targeting. Building and maintaining credibility requires consistent policy actions and clear communication.

- Global Economic Conditions: External factors such as global commodity prices, geopolitical tensions, and international financial market volatility can influence domestic inflation and complicate RBI’s policy choices.